Santana not worth the tariff

|

Any contending team in a major market would want Johan Santana to anchor its starting rotation. Yet the Minnesota Twins have not been able to trade the two-time Cy Young award winner despite months-long talks with the New York Yankees and Boston Red Sox, and more recently, the New York Mets.

An economic analysis of the potential trades indicates that the reluctance of the Yankees and Red Sox to make a deal is well-founded because the potential value of the young players the Twins want in return is so high. A trade makes somewhat more sense for the Mets.

A means of measuring the value of a star player such as Santana is to calculate the number of wins he produces. And wins, in turn, generate revenues. The protracted negotiations center on how much of the return on the asset – Santana – will go to the Twins in the form of young talent, rather than cash to Santana himself.

Free agents own their rights, so virtually all value accrues to the player. At the other end of the spectrum is a player such as Miguel Cabrera, who is under team control for another two years. The Florida Marlins were able to extract value from the Detroit Tigers because the Marlins were passing along control of a valuable asset. The Twins are caught between those two scenarios. Santana is only one season from free agency, so much of his value is shifting from the team to the player, yet the Twins seem to be pricing Santana as if he has two or three years remaining until free agency. This trade is basically free-agent signing with a tariff tacked on – a payment to the Twins in the form of promising low-salaried prospects in exchange for the right to sign Santana to a long-term contract without a bidding war.

If Santana had the patience to enforce his no-trade clause and insist on playing the final year of his contract in Minnesota, he could get all the spoils next offseason by becoming a free agent rather than sharing his bounty with the Twins. The Twins are demanding a substantial tariff for the right to pay Santana market wages. In effect, they're asking the team to pay twice. And in this case the tariff may cost nearly as much as the goods.

How can we place a dollar value on the tariff the Twins are demanding? Let's look at the financial implications to the Yankees of making Santana their staff ace, by breaking it down into two separate analyses – the free-agent value of Santana and the financial value of the Yankees players who reportedly would go to the Twins – promising starting pitcher Phil Hughes, center fielder Melky Cabrera, and one or two minor leaguers.

Santana's Free Agent Value to the Yankees

At the core of Santana's value as a free agent is his ability to improve his new team and the resulting financial impact of that improvement. I've analyzed the Yankees' revenue streams and statistically estimated the impact of winning on their revenues. (This topic is covered in-depth in my book, "Diamond Dollars: The Economics of Winning in Baseball.") One of the most important conclusions of this analysis is that not all wins are equal – the highest value wins are those which give the team a better chance of making the playoffs. In the case of the Yankees, maintaining their unbroken string of playoff appearances is worth an estimated $39 million in future revenues coming in the form of merchandise sales, retention of season-ticket holders, maintaining the high level of demand from their corporate sponsors, and continued top ratings on the YES Network, in which they own a stake.

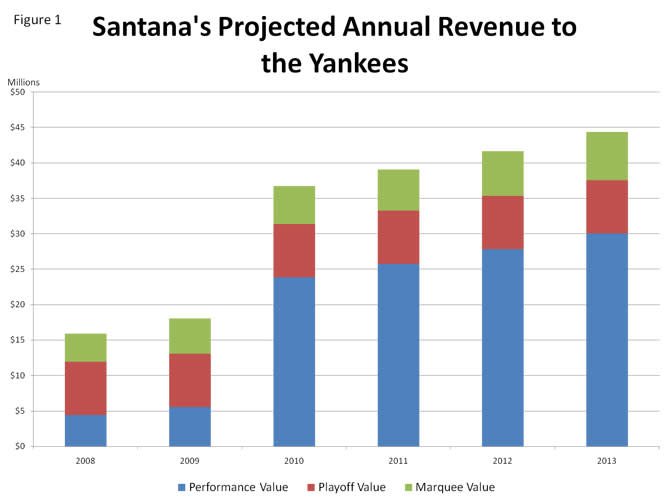

Adding Santana could provide an insurance policy on their consecutive string of playoff appearances and help their chances of bringing the Yankees their 27th world championship. According to the win shares stats at "Hardball Times," Santana's stellar pitching has been responsible for about eight of his team's wins each of the past four years. By bumping the Yankees' fifth starter to the bullpen, we can expect Santana's presence in the rotation to add a net of five wins per year. If we consider the star-studded, A-Rod-anchored Yankees to be a 93-win team before adding Santana, then we can say that his presence projects the club to 98 wins. Based on an analysis of recent history in the highly competitive American League East, those five wins would raise the Yankees' chance of reaching the postseason from an already strong 62 percent to a comfortable 91 percent. The expected dollar value of this increase would be modest over the next two years while fans flock to see old Yankee Stadium for one last time in 2008 and sample the new stadium in 2009, regardless of the team's won-loss record. But by 2010, when the new stadium is passé, I estimate those five wins will be worth a cool $24 million per year in incremental revenue, driven by how Yankee fans historically respond to a playoff-bound ballclub, along with the impact of the new stadium's higher ticket pricing and additional luxury suites.

Beyond his impact on the Yankees' regular-season win total, there are two other ways Santana can add financial value. First, he can play an important role once the Yankees reach the postseason. Santana gives the Yankees a better chance of riding the back of a top pitcher deep into October, much like the role Josh Beckett played for the Red Sox in 2007. Each additional rung on the playoff ladder creates more financial value as a team sells more merchandise, takes a more aggressive ticket price hike and has higher broadcast ratings in the following season. The difference between advancing one additional round in the postseason – getting to the World Series versus losing in the league championship series – can mean as much as $15 million to the Yankees. It's difficult to predict how much value Santana will deliver as a postseason player, but if we make the assumption that his presence increases the Yankees' chances of advancing one additional round by 50 percent, we can credit him with another $7.5 million in expected value.

Beyond his regular-season performance value and potential playoff impact, the final dimension of Santana's worth to the Yankees is his marquee value – the value that accrues to high-profile, star players by helping to personalize the team's brand and support their winning image. This is the toughest value component to quantify.

However, given Santana's stature and his potential popularity as the ace on the highest valued team in MLB, we can ascribe about $4 million in additional value per year. This approach divides one-third of the annual appreciation of the Yankees franchise among the star players on the team. If we assume the Yankees appreciate in value by about $75 million per year, then collectively the star players – Rodriguez, Derek Jeter, Mariano Rivera, Robinson Cano, Jorge Posada and now Santana – could be responsible for about $25 million of the annual appreciation. (Figure 1 shows the projected revenues of Santana as a Yankee.)

On the cost side, we can expect the tab for Santana to be in the neighborhood of $25 million a year for six years. Since the Yankees are over the luxury tax threshold and A-Rod's contract virtually eliminates any chance that they will go below it in the near future, the Yankees will be on the hook for another $10 million per year in luxury taxes, raising Santana's cost to about $35 million per year. The net result is that Santana would be a value-added signing for the Yankees, even at his steep price – generating about $225 million in revenues and asset appreciation and costing about $200 million, yielding a rate of return of 24 percent on their investment, probably enough to compensate the Yankees for the injury risk associated with any free agent pitcher.

The Value of Hughes and Co.

Let's look at the price the Yankees would need to pay the Twins in order to secure Santana. A team's most valuable assets are its young major leaguers with five or six years of discounted wages ahead of them before free agency. Let's make the conservative assumption that Hughes pitches at the level of a number three starter – akin to the 2007 version of the Cubs' Rich Hill, or the Giants' Matt Cain – for each of the next six years. That means Hughes would be worth about three marginal wins above a replacement player per season. Hughes will be paid a modest (less than $500,000) annual salary over the next two years until he reaches arbitration eligibility. By looking at comparable players and adjusting for inflation, we can estimate that he should earn about $30 million in the next six years. Alternatively, his team would need to pay about $84 million in free-agent wages to buy the same wins. So Hughes' asset value is more than $50 million – the amount of payroll savings he will generate for the team that owns his contract versus buying his performance in the free-agent market. (See Figure 2.) By including Melky Cabrera in the trade, another $10 million in asset value is added, and another pitching prospect further bumps up the total cost of the deal.

The net impact for the Yankees is a contract extension for Santana that gets the Yankees about $25 million in value, but is more than offset by trading Hughes, Cabrera and one or two other minor league prospects, giving up about $60 to $70 million in value. What would need to happen to make this a good trade for the Yankees? If Santana signs with the Yankees at $5 million to $7 million per year below the price he would have gotten in an open bidding war as a free agent next winter, or if Hughes becomes only a fifth starter or bullpen reliever, the deal could make sense for the Yankees.

The Red Sox and Mets

For the Red Sox, a trade is even more difficult to rationalize, driven by the lower free-agent valuation of Santana in a sold-out Fenway Park. Santana's financial value to the Red Sox is in the range of $18 million to $20 million versus his annual value of over $30 million to the Yankees. Starter Jon Lester's value may be lower than Hughes' value because Lester has fewer years remaining until free agency, and outfielder Jacoby Ellsbury's value is likely less than Hughes' due to the premium paid to starting pitchers. However, neither of these facts changes the reality that the free-agent cost of Santana alone is likely more than his worth to the Red Sox. It may be that the only reason they are involved in trade talks is to bid up the acquisition price of Santana for the Yankees.

The discussions between the Twins and Mets may hold the most promise. Acquiring Santana and signing him to a long-term deal is economically viable for the Mets because they have a new stadium in the works, their revenue would spike if they reach the postseason and they could remain under the luxury tax threshold. Santana's potential revenue value to the Mets would average an estimated $40 million per year and would exceed his cost by about $100 million over six years, assuming the Mets can stay under the luxury tax threshold. This justifies the Mets packaging a combination of prospects from the list of Philip Humber, Carlos Gomez, Deolis Guerra, Kevin Mulvey and Fernando Martinez. If three of the five prospects materialize into a number three pitcher in the rotation, a starting outfielder and a solid relief pitcher, then the Twins and the Mets receive about the same value in the trade.

One factor working in favor of a trade is the Twins' unwillingness to pony up the dollars to sign Santana to a long-term deal, which eventually could prompt them to lower their demands. On the other end of the deal, a team desperate for Santana could ignore the dramatic financial value created by developing front line pitching internally and take on the injury risk associated with giving a long-term deal to a starting pitcher who has averaged 228 innings over the past four years.

Any team who makes this trade will likely set its farm system back while placing a tremendous investment – and therefore risk – in one player. But if Santana ends up taking the hill in Game 1 of the World Series, the deal will considered a good one.

Vince Gennaro is a consultant to several Major League Baseball teams and the author of "Diamond Dollars: The Economics of Winning in Baseball," an innovative look at the business of baseball. This followed a 20-year career at PepsiCo, where he was president of a billion-dollar division. Gennaro teaches a graduate course on the business of baseball in the Sports Business Management program at Manhattanville College. Send Vince a question or comment at vgennaro07@yahoo.com.