"I Feel Like It's Never Going To End": People Are Talking About How They're Dealing With Prices Going Up Everywhere In Their Everyday Lives

Inflation has been soaring lately, with experts saying it's near a 40-year high. I live in California, so one of the places I've noticed it the most is at the gas station, where regular cost more than $6 per gallon the last time I "filled up" (read: bought a quarter tank 'cuz I'm not made of money).

Netflix / Via giphy.com

I was curious how inflation is changing people's budgets, so I asked members of the BuzzFeed Community to find out how they're coping. Some people shared money-saving hacks and budget swaps, and others are understandably just really struggling. Here's what they had to say:

1."I’m lucky to live in a place where I can do this, but both my husband and I have been biking way more and driving a lot less. We’ve always done this but have stepped it up recently."

"I’ve also started ordering groceries for pickup rather than going into the store — that way I can be sure I’m getting what I need, and I’m not tempted to buy 50 extra items. We used to eat out multiple times a week and have cut that back to once or twice a month. None of this is saving us all that much, but anything is helpful these days."

2."To save on driving, I group errands together that are in the same location. Don’t drive 5 miles down the highway on Tuesday to get a deal on chicken when you know you have to drive 4 miles down the highway on Wednesday to pick up your daughter from soccer practice. Buy the chicken on Wednesday. Madison can sit in the car for three minutes while you run in and buy the chicken real quick."

—Anonymous

3."Buying less alcohol so that when I sell my kidneys they’ll get a better price."

4."If you're paying off credit cards, forget balance amount — look at interest rate. Tackle the highest interest rate first, paying minimum payment on all others. Ask friends if they want to share streaming accounts. Set up profiles under a shared account and Venmo/Cash App an agreed upon amount each month for sharing."

"At the grocery store, look high and low on the shelves. Most people only ever look at the middle area of shelves, and that’s usually the most expensive stuff. For the things you typically buy, check similar items on the top and bottom shelves (use that 'cost per unit' in the top left of the sticker to truly compare prices for what you get!)."

—Anonymous

5."During the pandemic with the student loan pause, we were able to save for the first time ever. Had like $2K in cash in a hiding spot. Slowly we stopped being able to save, and then we had to start dipping into it for regular expenses. The cash is gone now, so it's back to belt-tightening."

"I don't know what to do when we have to start making payments on student loans again — that's another $300 at least a month that we definitely do not have. It's exhausting working harder and harder and never catching up."

6."I am not eating more than two meals (or actually snacks) a day. And I am still running out of money three days after payday."

7."How do you change your budget when housing and food are going up? There's not much wiggle room when rent is skyrocketing and basic food (necessary to live) is more expensive. I guess I'm privileged enough to stay home and not spend as much on gas, so the extra money I'm not dumping into the tank can go to the higher rent and food?"

"My yearly raise was not adjusted for inflation, so it has been eaten up by this mess. I was already using water filters instead of buying bottled water, making food at home, eating vegetarian/vegan, negotiating interest rates, and cutting subscriptions, and inflation is still messing me up. Maybe I'll get on the pole for some tax-free dollars next."

8."My elderly mother and I are just running out of money during the last week of every month and eating whatever we can find in the back of the cupboard and freezer. Sweet hack!"

"Honestly, I did apply for SNAP this month, and it came through. It has helped a lot! We are looking into what else may be available."

9."I decided to hit up the world of online surveys. I found one that gives points even when you don't qualify. It's not much, but the pennies eventually add up. I'm also on permanent disability so I decided to apply for every government resource I qualified for."

"Finally, I wrote my credit card companies and asked them to reduce my interest. My FICO score has jumped by more than 150 points since opening these accounts."

—Anonymous

10."I only shop online, even for groceries. I can do a much better job of finding the cheapest price per unit if I can see all of the options on one page. It also makes it much easier to buy individual items at the stores they are cheapest at without wasting gas riding around town."

"Speaking of gas, I'm serious about filling up every time I'm down to three quarters of a tank. It doesn't make the gas any cheaper, but it's much easier to fit a quarter tank into my budget than a filling up half a tank or a full tank.

I use Ibotta, Fetch, Dosh, and Capital One Shopping. This gives me cash back and gift cards for the things I buy. I don't really buy a lot, but those incentives really add up in a month's time."

—Marissa, North Carolina

11."Skipping breakfast. I've been buying the other members of my house regular bread, pasta, etc. (I have celiac disease and have to eat gluten-free.) It’s safest to have the whole house gluten-free, but we can’t afford it anymore, which puts me at a great risk of getting ill. We're also not visiting family as much due to gas prices."

12."I’m not taking a major vacation this season while I watch most of my friends revenge travel. I’m banking that cash and stockpiling it for a rainy recession day. Instead, I’m going to local hidden gems and honestly, trying to build friendships with people who have nice vacation properties I can visit with them. Grifting is the ultimate inflation strategy."

—Sarah, Colorado Springs

13."I live with a couple of other people — I pay for about 50% of the household groceries, and they pay for the other 50%. Part of how we're working on spending is going back to our standard grocery list and meal planning, which slipped a little in the past few months. Knowing what we're going to eat for the next two weeks means less trips to the store and less money spent overall."

"We're lucky in that I'm working from home, so I can make dinner for everyone without too much added stress. Additionally, the people working outside the home are taking their lunch with them again instead of buying lunch downtown or at a food truck. It's just leftovers or a sandwich, but not going out for lunch all the time makes a huge difference."

—Anonymous

14."I'm hoping my husband gets his overtime for a project approved. If he gets this, it would only be for a few months, but it would help so much to have a little extra. Right now, we have cut back on going out to eat or takeout and doing it only once a month or so. We're trying to make better food choices, which is hard with three extremely picky eaters who are autistic. It's been hard, and I feel like it's just never going to end."

15."I know this is privilege, but buying in bulk has saved my bank account lately. I got my phone plan through Mint Mobile for $40 a month for two lines by paying for a year in advance. A special shake I need for a health condition went from $1.50 to $3 a shake, but I was able to buy it by the case and get the price back down to $2. Same with toilet paper, contact lenses, and other stuff that I’m lucky to be able to store a lot of. I dipped into my savings to do some of this, but now I’m sticking to the budget I had before inflation took off."

16."Family of five here. I’m lucky enough to work a hybrid job in healthcare, so I only go into the office twice a month to cut gas costs. Monday is my errand day, and I get everything done in town on that day so I don’t have to go anywhere else the rest of the week. My weekly grocery bill is now $350–$400."

"I buy store brand goods when there is an option to. I have a vegetable garden that offsets some produce costs. We save leftovers and eat them for lunch the next day. Our AC is set at 78 degrees. I honestly don’t know how some people are surviving."

—Anonymous

17."During the pandemic, my income increased significantly, and with home-schooling stress and working full time remotely, we found ourselves ordering delivery on the regular. Now with inflation creeping up, I'm trying to budget and eat like we did before my income increase. It's tough to change those habits back, but cooking at home is def cheaper overall, as long as you have cooking basics already."

—Toni, Utah

18."I have been ordering cat food in bulk because it has been so scarce on the shelves around here. It is nice to have a whole bunch of something essential and to know we won't run out before payday."

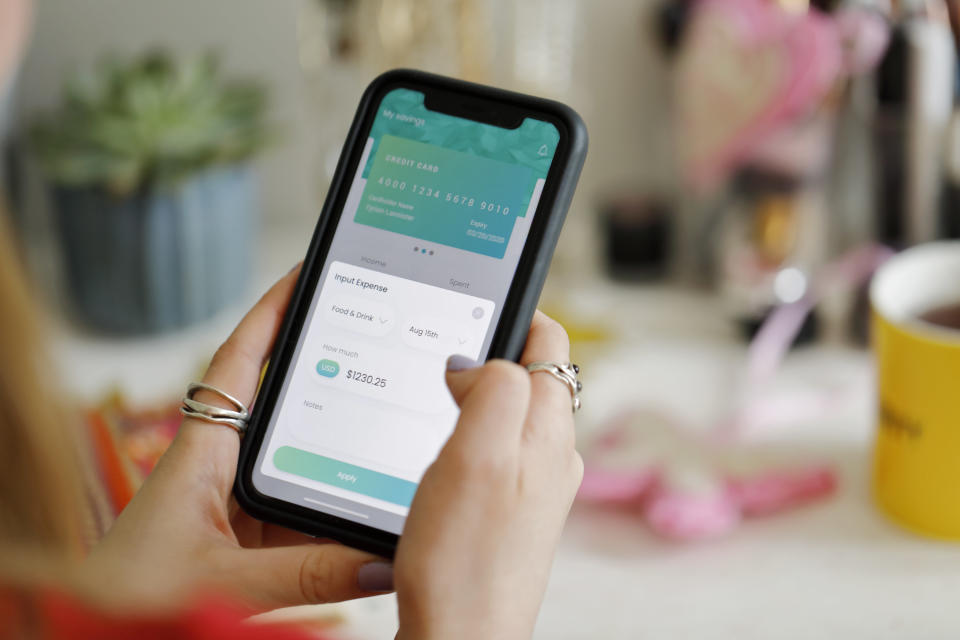

19.And finally, "As a 21-year-old who is looking to move out soon, having multiple savings accounts has been extremely helpful for me. I have three savings accounts: one for a future down payment, one for a new car, and one general savings account. I also only keep a set amount in my checking account so that I am not tempted to misspend and overspend."

"The Mint app is a great tool for building your wealth. You can connect all of your accounts to see your net worth, understand your spending habits, and track your income, purchases, and savings. You can create savings goals and connect those goals to an account to see your progress."