Third NBA Rights Option Emerges for David Zaslav and Warner Bros. — Match Amazon’s $1.8 Billion Bid

Like an NBA team deciding how to defend an unstoppable opponent, a popular narrative has emerged that Warner Bros. Discovery is in a pick-your-poison scenario, whereby it either has to overpay to match Comcast NBCUniversal’s rival $2.5 billion-a-season bid for NBA rights or face a bleak future in which its TNT loses one of the most vital live sports packages.

But reading between the tea leaves Thursday during WBD’s first-quarter earnings call with investors, a third option may have emerged: Warner and TNT Sports could merely match the $1.8 billion bid put forth by Amazon.

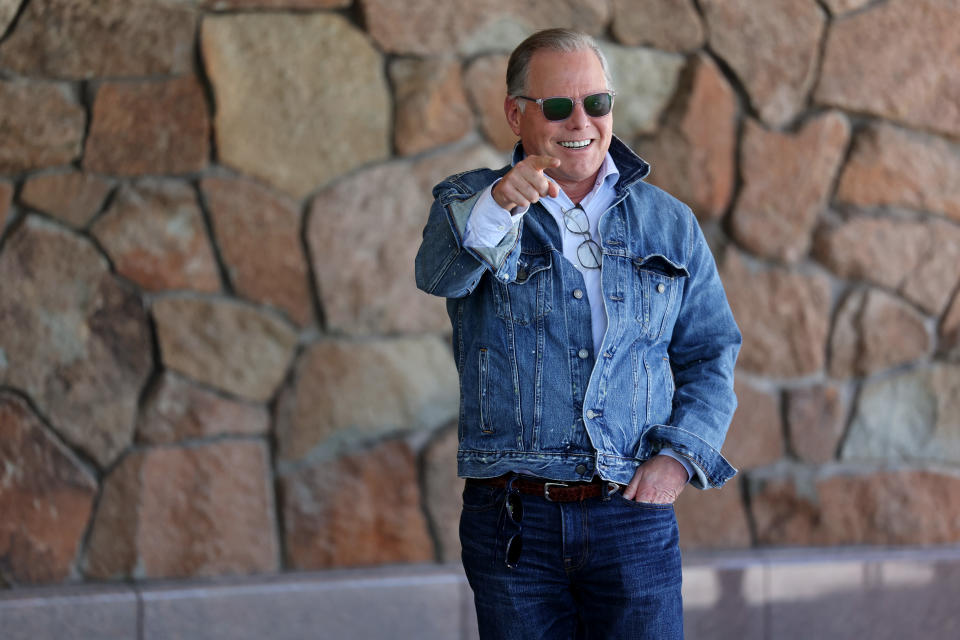

“We’ve had a lot of time to prepare for this negotiation, and we have strategies in place for the various potential outcomes,” WBD CEO David Zaslav told equity analysts. ”However, now is not the time to discuss any of this. Since we are in active negotiations with the league and under our current deal with the NBA, we have matching rights that allow us to match third-party offers before the NBA enters into an agreement with them.”

Calling it “the nuclear option,” the New York Post pondered an outcome whereby WBD blocks Amazon instead of Comcast NBCU. A source familiar with the negotiations told Next TV such a scenario is indeed possible, given that WBD has such "strong backend rights."

Last week, it was revealed that the NBA had reached an agreement in principle with Disney/ESPN, which will see the annual average price for its current NBA games package -- which includes the NBA Finals — increase from $1.4 billion to $2.6 billion, starting in the 2025-26 season.

The NBA also reached agreement on a basic framework with Amazon, creating a third partnership for national TV rights.

Meanwhile, Comcast stepped in, rendering an aggressive $2.5 billion bid to poach the NBA rights package WBD has controlled since 2007. On Thursday, Sports Business Journal reported that Comcast and NBCU are now in the "drivers seat" on securing a third NBA national TV package, and that WBD would have to come up with around $2.8 billion a season to retain these rights.

Matching Amazon’s bid would increase WBD’s annual payment to the NBA well above the $1.2 billion a season it’s paying in its current contract. But the price bump would be far less than trying to match Comcast’s insurgent bid.

Certainly, an outcome that sees WBD take Amazon’s rights package would not sit well with the league, which reportedly covets the opportunity to work with a big technology company. And it might not sit well with Amazon, either, which would certainly seem to have the resources to up its bid, if necessary.

And it’s unclear at this point what game assets sit in the rights package earmarked for Amazon, but it is known to be significantly less robust than the NBA package TNT currently enjoys. Notably, TNT would lose the All-Star Game, something that could become an issue in pay TV affiliate negotiations.

In the background are the complications created by Zaslav, who notably said on several occasions in the run-up to renewal negotiations that WBD didn't need the NBA.