Sterling loses steam as UK GDP misses estimates and COVID-19 cases mount

The pound’s mid-week gains against the euro and dollar have worn off as the Office for National Statistics (ONS) reported disappointing UK economic data and markets accepted that a viable COVID-19 vaccine won’t enter the market immediately.

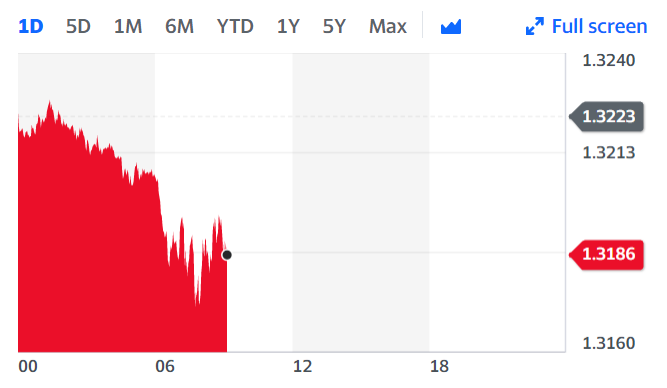

The pound was 0.27% lower against the dollar (GBPUSD=X) and 0.4% lower against the euro (GBPEUR=X) on Thursday around 9:10am in London.

The UK economy grew by a record 15.5% between July and September, the ONS said on Thursday, showing a partial recovery for the UK economy before the second wave of COVID-19 hit. This figure missed economists’ estimates that third quarter GDP would grow by 15.8%.

The UK is “on the wrong trajectory heading into what is going to be a rough Q4,” said Connor Campbell, financial analyst at Spreadex.

“After days of election and vaccine celebrations, investors suffered a comedown, causing the European markets to hit a wall on Thursday,” he added.

Delays in Brexit negotiations added to sterling’s fall, as markets accept that “a Brexit agreement remains out of reach,” said Marshall Gittler, head of investment research at BDSwiss.

On Thursday, UK housing secretary Robert Jenrick said: “We hope that in the days ahead, admittedly time is short, but in the days ahead both sides will be able to reach agreement and the EU will show some further flexibility in those respects if it can.” He made the comments to BBC Radio.

Watch: Why can't governments just print more money?

Sterling’s fall also reflects wider dampened market sentiment.

The extended global equity rally lost steam at the European market open on Thursday. The FTSE (^FTSE) was lower by 1% at around 8:45am in London. Elsewhere in Europe, the CAC 40 (^FCHI) fell by 0.7% in Paris and the DAX (^GDAXI) dropped by 1% in Frankfurt.

Sterling was previously the greatest benefactor of improved investor sentiment this week, advancing to a two-month high that followed news of Pfizer’s (PFE) successful COVID-19 vaccine candidate.

READ MORE: Markets pare gains as coronavirus vaccine euphoria wears off

Despite the news bringing initial relief and a subsequent rally in markets, infection and hospitalisation rates are still rising, suggesting that the situation will worsen on the ground over the winter as a second wave grips various countries.

As a result, economists are not optimistic about the UK’s Q4 outlook.

“The second lockdown has prompted us to pencil-in a 6% month-to-month drop in GDP in November, followed by a 5% rise in December; the rebound will be incomplete as we doubt the government will choose to return fully to the loose COVID-19 restrictions that were in place in October, said Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

“All this suggests that GDP will decline by about 0.5% quarter-on-quarter in Q4 and that on a monthly basis, it probably won’t recover to September’s level until the spring, when it should be possible for COVID-19 restrictions to be sustainably relaxed.”

Watch: What is a budget deficit?