Element Solutions (ESI) Announces $400M Add-On to Existing Loan

Element Solutions Inc. ESI entered into an agreement in principle on pricing and syndication for a $400 million add-on to its existing senior secured term loan B due 2026, subject to certain conditions.

The add-on is subjective to the closing of the earlier-announced acquisition of Coventya Holding SAS as well as finalization and execution of its definitive documentation. The proceeds from the add-on will be utilized to finance a portion of the €420 million consideration for the Coventya Acquisition and transactions costs, fees and expenses related to this transaction and the Add-On, and for general corporate purposes.

The funding of the add-on is anticipated to close concurrently with the Coventya Acquisition, whose completion is subjective to certain closing conditions.

The company noted that upon closing of this financing, it will have fully financed its pending acquisition of Coventya. It looks forward to providing further updates on this transaction on its second-quarter earnings call.

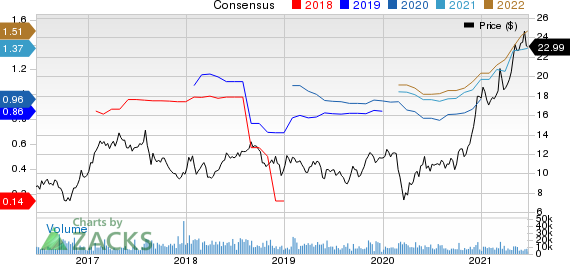

Shares of Element Solutions have gained 114.1% in the past year against 14.8% decline of the industry.

Image Source: Zacks Investment Research

In its first-quarter call, the company increased its adjusted earnings per share guidance to at least $1.30, up from the prior view of $1.10-1.15. It currently expects adjusted EBITDA in the band of $500-$510 million. Moreover, it anticipates generating free cash flow of $285 million for 2021, up from $275 million expected earlier.

For the second quarter, the company sees adjusted EBITDA in the range of $125-$130 million. It expects higher raw material prices and other cost inflation to slightly impact profitability.

Element Solutions Inc. Price and Consensus

Element Solutions Inc. price-consensus-chart | Element Solutions Inc. Quote

Zacks Rank & Other Key Picks

Element Solutions currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Nucor Corporation NUE, Olin Corporation OLN and Cabot Corporation CBT.

Nucor has a projected earnings growth rate of around 344.9% for the current year. The company’s shares have surged 131.7% in a year. It currently flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Olin has an expected earnings growth rate of around 506.7% for the current year. The company’s shares have skyrocketed 307.7% in the past year. It currently sports a Zacks Rank #1.

Cabot has an expected earnings growth rate of around 137.5% for the current fiscal. The company’s shares have surged 57.4% in the past year. It currently flaunts a Zacks Rank #1.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 77 billion devices by 2025, creating a $1.3 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 4 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2022.

Click here for the 4 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research