Buying a starter home is cheaper than rent in two dozen metro real estate markets

Nikki Daniel’s rent had jumped twice – in just the past two years.

For this year, she was looking at an increase from $1,275 to $1,350 for a three-bedroom house in McCalla, Alabama, a suburb of Birmingham. That's a nearly 6% jump with no guarantee that there wouldn't be further increases at a time when inflation has increased food and gas prices.

“I knew my mortgage payments would be lower than my rent,” said Daniel, who works at an auto plant.

About a year ago, on the advice of her realtor, she decided she had to get her credit in order so she could buy a home.

In August, Nikki and her husband, John, bought a three-bedroom house for $265,000 just two blocks away from their rental home.

After putting down 3.5% of the cost as a down payment and using an FHA loan to finance their mortgage, their monthly payments are $1,250 – lower than what they were paying in rent two years ago.

►When showing becomes stressful: Climate change shapes where Americans relocate

►Can 'love letters' from home buyers perpetuate racism? This state thinks so

The Daniels are taking advantage of a trend that is sweeping the country: Buying a starter home now costs less per month than renting a similar-sized unit in 24 of the 50 largest U.S. metros, according to a recent Relator.com report.

Rents keep increasing making mortgages attractive

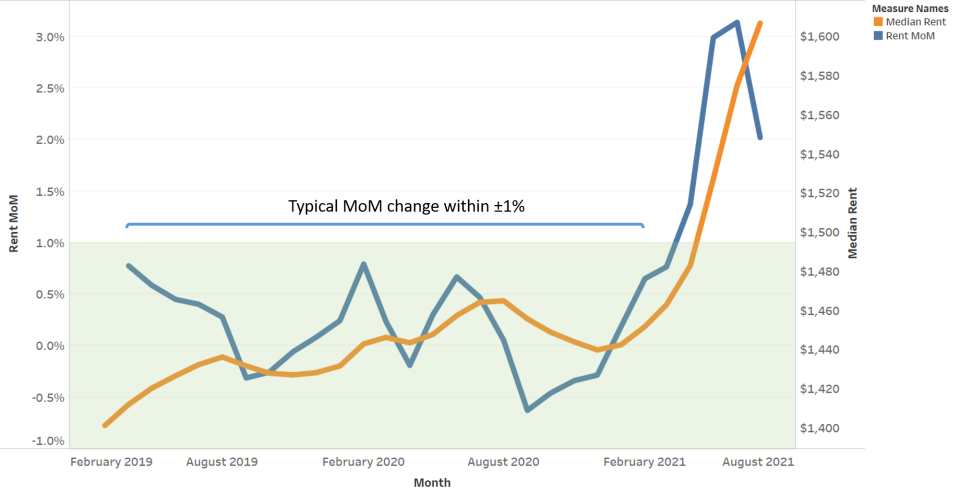

This is possible because rents continue to rise at a harrowing clip – up 10% in July over last year and 12.2% since 2019 – while and mortgage rates remain low.

Birmingham, one of America’s most iconic cities for its civil rights movements, tops the list of markets that favor buying.

There, the monthly cost of buying a “starter” home (defined as studio, one or two-bedroom dwellings) was $728 in July, which was 33% less than the monthly rent of $1,089, for a monthly savings of $361. That's more than $4,000 over a year.

Other top markets where it’s more affordable to buy a starter home versus rent include St. Louis (29.4% lower), Pittsburgh (28% lower), Orlando, Florida (26% lower) and Cleveland (26% lower).

“Rents hit new highs in 40 of the 50 largest U.S. metros this July and grew at an almost double-digit pace – the fastest yearly rate we’ve seen in the last 18 months,” said Danielle Hale, chief economist for Realtor.com.

Monthly starter home costs are on an average 15.5% ($216) lower than rents in nearly half of the 50 largest U.S. metros, according to the report.

If first-time buyers were worried about monthly costs to take the homeownership plunge, data suggests it’s worth exploring in many markets, said Hale.

Looking for starter homes outside of crowded cities

While housing inventory remains historically low, the number of homes for sale in July decreased by 33.5% over the past year, a lower rate of decline compared to the 43.1% drop in June.

Many of July’s highest rent gains were seen in secondary markets where rental demand has exploded during COVID-19, driven in part by remote work enabling employees to escape crowded, expensive big cities, said Hale.

First-time homebuyers in July’s highest-priced rentals experienced a respite compared to renters as companies around the country are expecting vaccinated Americans to slowly head back to offices.

In the top 10 metros that favored first-time homebuying over renting in July, monthly starter home payments were an average 24.3% lower than rents, driven in part by lower median listing prices ($192,000) than the national average ($297,000).

As Americans looked for more space during the pandemic, larger units led the rent growth.

The median monthly rent for two-bedroom units increased by $238 (15.2%) since July 2019.

Mounira Affoune had been renting a one-bedroom apartment for $700 a month in Pittsburgh with no lease.

With two girls, her need to move into a two-bedroom was urgent.

But when she explored her rental options for two bedrooms, they were close to $1,000 a month.

That’s when Affoune and her husband decided to put all of their savings toward a down payment and buy a $189,000 two-bedroom house in August. The monthly mortgage payments come to about $850.

“The girls are very happy,” she said. “We have a basement and a garden.”

Daniel in McCalla, who became a first-time homeowner at age 45, credited her real estate broker, Wyonna Baldwin, for giving her the right advice and encouraging her to buy.

“I had been working with Nikki for over a year while she was improving her credit score. I tell my clients, think about how many times you eat out a day and start saving from that point,” Baldwin said. “It was God’s grace that Nikki found her home. Sellers know that buyers are grasping at straws.”

Swapna Venugopal Ramaswamy is the housing and economy reporter for USA TODAY. Follow her on Twitter @SwapnaVenugopal

This article originally appeared on USA TODAY: Buy or rent? Where starter home mortgage payments cost less than rent