Bitcoin, Ether Drop Over 5% in Massive Sell-Off as Market Continues to Digest Silvergate

Join the most important conversation in crypto and web3! Secure your seat today

Major digital assets plunged as the business day began in Hong Kong on Friday.

Bitcoin (BTC) and ether (ETH) both dropped more than 5% as customers fled crypto bank Silvergate, whose stock tumbled 58% during U.S. trading Thursday. Most of the other 10 largest cryptocurrencies by market cap saw declines similar to BTC and ETH's.

"Institutions are a bit jumpy as Silvergate seems to be having issues," Nick Ruck of ContentFi, a Web3 venture studio, said in a note to CoinDesk. Ruck also pointed to the release of some of Mt. Gox’s bitcoin, which would increase its circulating supply, as another source of volatility.

Read More: Was Silvergate on Borrowed Time as Regulators Backed Banks Away From Crypto?

The rapid sell-off took a toll on major crypto exchange Coinbase, which began experiencing connectivity issues at 10:20 a.m. Hong Kong time. Other major crypto exchanges, including Binance, Bitfinex, Kucoin, OKX and Kraken, did not report similar issues.

Bitcoin’s price fell to an intraday low of $22,020 as Asia trading hours began, after remaining roughly steady at $23,500 for most of the past day. It appeared to rebound slightly, recovering to just under $22,400 following its plunge.

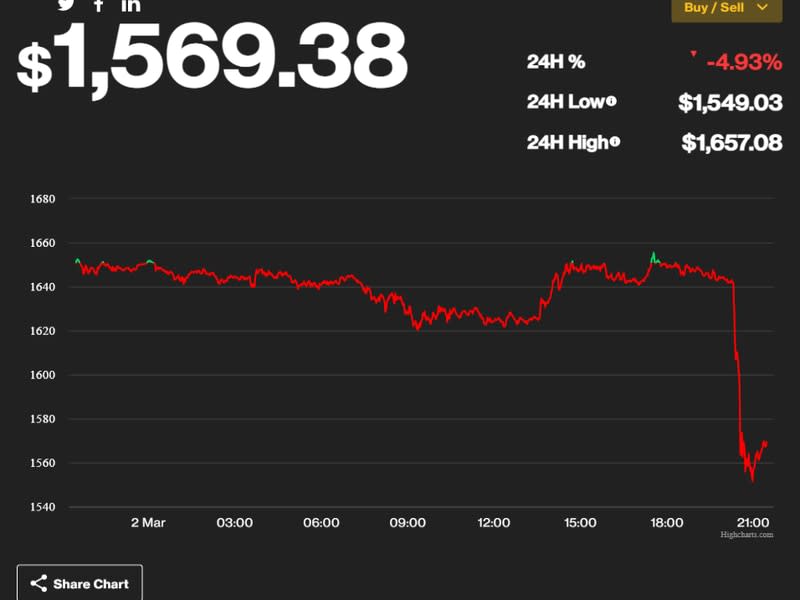

Ether saw a similar pattern, falling to $1,550 after spending the past day hovering around $1,650 with limited change.

Bitcoin’s market cap declined by over $20 billion to $431.9 billion, according to CoinMarketCap. Crypto's overall market cap is at $1.07 trillion. Open interest in bitcoin futures was down 8.8% in the last four hours, according to Coinglass. Open interest for ether was down 5%.

UPDATE (March 3, 2023, 02:45 UTC): Adds additional detail.