3 Big Stock Charts for Tuesday: Biogen Inc (BIIB), Lockheed Martin Corporation (LMT) and McDonald’s Corporation (MCD)

The earnings cycle is sending some mixed signals for the first time this quarter as three more widely watched stocks provided just “OK” earnings results for the quarter. With the major indices trading at their all-time highs, “OK” results are usually likely to cause traders to start hitting the “sell” button, as we’re seeing on a few stocks today.

Today’s three big stock charts analyze the price patterns of Biogen Inc (NASDAQ:BIIB), Lockheed Martin Corporation (NYSE:LMT) and McDonald’s Corporation (NYSE:MCD) as two out of three of these companies are trading lower in the wake of their earnings results creating potential buying opportunities.

Biogen Inc (BIIB)

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Biogen shares traded strongly right into their earnings report, suggesting that the company needed to nail their earnings report to avoid a “sell the news” situation that would take BIIB stock back into its trading range. The report didn’t blow investor’s hair back, so let’s see what the chart says now:

Biotech stocks have been losing their leadership in the market over the last two weeks while Biogen has continued to trade higher. This created the “sell the news” reaction that we are seeing to the company’s earnings today.

Today’s selling is taking BIIB stock below its 50-day moving average, currently at $315. A break below this trendline will increase selling pressure.

Biogen shares MUST avoid a move below $300 to avoid another 5-10% drop. This price represents the bottom Bollinger Band and round numbered support. A break of both will cause knee-jerk selling pressure that will test the $185 price in BIIB quickly.

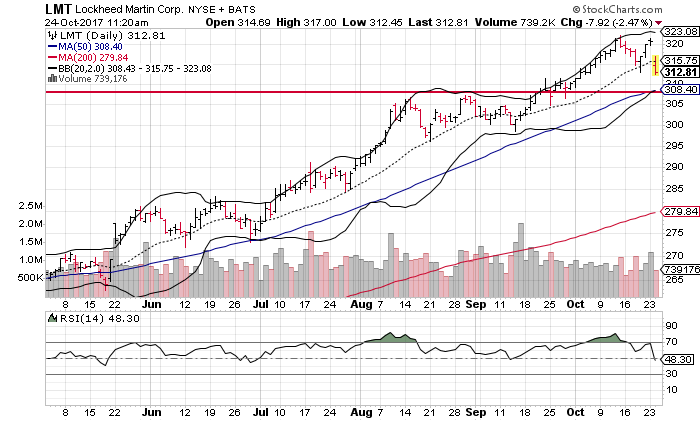

Lockheed Martin Corporation (LMT)

Defense stocks have been among the groups of stocks posting strong, low volatility rallies, you know, the kind everyone likes. The problem happens when a company like that misses earnings, the way that Lockheed Martin did. This quarter’s results missed expectations, although management did guide forward earnings higher, which is the saving grace right now.

So, is LMT stock a buy on this dip?

According to the trend of the 50-day moving average, Lockheed shares are at risk of transitioning into a neutral technical outlook.

LMT shares have been recoiling from a technically overbought signal that triggered on Oct. 12, as the stock topped-out just above $322. Momentum indicators suggest that the selling pressures related to this bearish signal have yet to be exhausted. This means that Lockheed shares have further downside over the short-term.

Traders will want to watch the 50-day trendline for support and a “buy the dip” opportunity. This price is currently at $308. A break below this trend will turn LMT shares bearish.

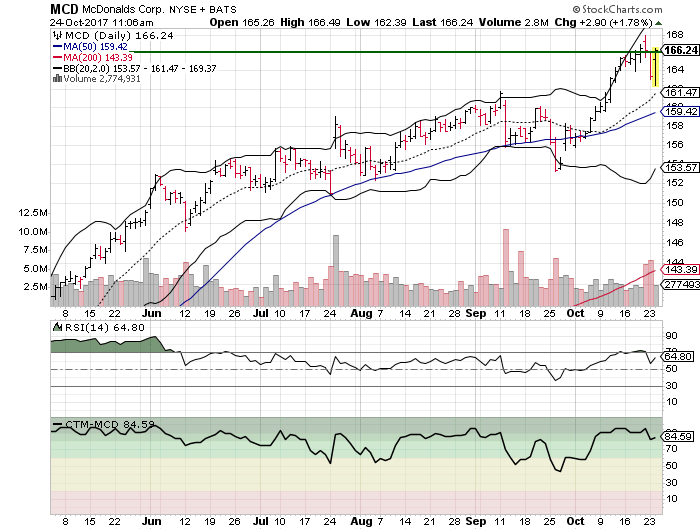

McDonald’s Corporation (MCD)

McDonald’s shares are moving higher today after the company issues a mixed earnings report. The company missed on the bottom line, but showed an increase in its margins because of the conversion of stores from being company-owned to franchisee-owned.

Bottom line, the Golden Arches are going to move higher from this report, at least that’s what the MCD stock charts are saying.

McDonald’s shares went on a wicked rally over the last three weeks as traders bought ahead of the report. As a result, we saw some selling pressure from the overbought readings that have created a perfect post-earnings “buy the dip” signal.

MCD shares should see some technical support at $62 from the combination of round-number chart support and the short-term 20-day moving average that fast money traders are likely watching.

McDonald’s shares will likely take a pause today at $166. However, a break above this price will confirm that the trend is ready to remain MCD’s friend with higher price targets through the rest of the year.

As of this writing, Johnson Research Group did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post 3 Big Stock Charts for Tuesday: Biogen Inc (BIIB), Lockheed Martin Corporation (LMT) and McDonald’s Corporation (MCD) appeared first on InvestorPlace.