David Einhorn Adds Calpine, Rite Aid, Amaya to Portfolio

- By Sydnee Gatewood

David Einhorn (Trades, Portfolio) of Greenlight Capital acquired three new holdings during the second quarter. They are Calpine Corp. (CPN), Rite Aid Corp. (RAD) and Amaya Inc. (AYA).

Warning! GuruFocus has detected 4 Warning Signs with CPN. Click here to check it out.

The intrinsic value of CPN

Einhorn is president and founder of Greenlight Capital, which was founded in 1996. He is an activist investor. Activist investors take positions in a company and pressure executives to implement change. He believes intrinsic value will achieve consistent absolute returns and safeguard capital, regardless of market conditions. Einhorn holds stock in 46 companies and is worth $5.4 million. His quarter-over-quarter turnover rate is 16%.

Calpine

In Calpine, Einhorn purchased 5,660,000 shares for an average price of $14.82 per share. The transaction had an impact of 1.53% on the portfolio.

Capline, a wholesale power producer, has a market cap of $4.6 billion with an enterprise value of $16.3 billion. It has a forward price-earnings (P/E) ratio of 24.9, a price-book (P/B) ratio of 1.6 and a price-sales (P/S) ratio of 0.7. GuruFocus ranked its financial strength 3 of 10 and its profitability and growth 7 of 10.

The company has an operating margin of 10.2% and a net margin of -0.02%. Its Piotroski F-Score is 4, indicating a stable financial condition. Its Altman Z-Score is 0.17, placing it in the distress zone, which implies the possibility of bankruptcy in the near future.

Among the gurus invested in Calpine, Hotchkis & Wiley is the largest shareholder.

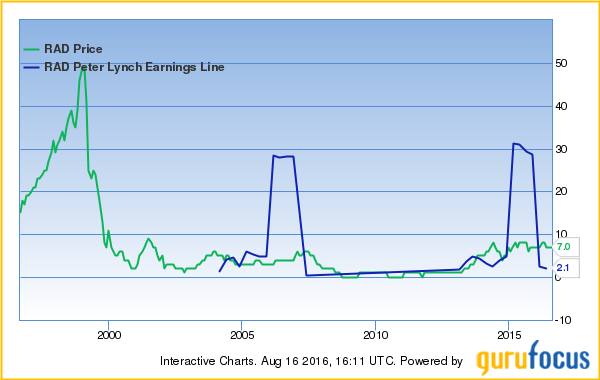

Rite Aid

In Rite Aid, Einhorn purchased 10,330,000 shares for an average price of $7.89 per share. The transaction had an impact of 1.42% on the portfolio.

Rite Aid, a retail drugstore chain, has a market cap of $7.9 billion with an enterprise value of $14.8 billion. It has a P/E of 54.3 and a forward P/E of 95.2. Its P/B is 13.5, and its P/S is 0.25. GuruFocus ranked its financial strength 5 of 10 and its profitability and growth 4 of 10.

The company has an operating margin of 2.2% and a net margin of 0.44%. Its Piotroski F-Score is 4, indicating a stable financial situation. Its Altman Z-Score is 3.02, placing it in the safe zone.

Previously, Einhorn sold out of Rite Aid in the second quarter of 2014. Among the gurus invested in Rite Aid, David Einhorn (Trades, Portfolio) is the largest shareholder, followed by Jim Simons (Trades, Portfolio).

Amaya

In Amaya, Einhorn purchased 3,962,684 shares for an average price of $13.77 per share. The transaction had an impact of 1.11% on the portfolio.

Amaya, a technology company involved in gaming, has a market cap of $2.3 billion with an enterprise value of $4.24 billion. It has a P/E of 37.2 and a forward P/E of 12.9. Its P/B is 1.5, and its P/S is 2.8. GuruFocus ranked its financial strength 4 of 10 and its profitability and growth 8 of 10.

The company has an operating margin of 18.4% and a net margin of 8.4%. Its Piotroski F-Score is 6, indicating a stable financial condition. Its Altman Z-Score is 0.72, placing it in a distress zone, which implies the possibility of bankruptcy in the near future.

Among the gurus invested in Amaya, David Einhorn (Trades, Portfolio) is the largest shareholder, followed by John Griffin (Trades, Portfolio).

Disclosure: I do not own stock in any companies mentioned in the article.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with CPN. Click here to check it out.

The intrinsic value of CPN