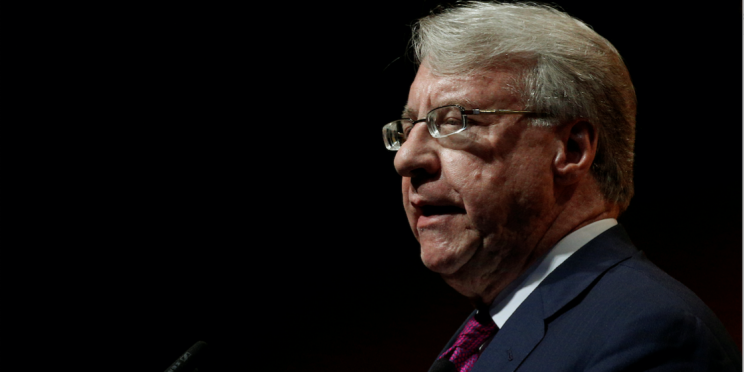

Jim Chanos: All the big money I've made has been under Republican presidents

Influential short-seller Jim Chanos says that he’s made the most money during Republican administrations.

In a recent interview with Capitalize For Kids, Chanos was asked if short opportunities are more prevalent under a Trump administration than they would have been under a Clinton administration.

“[Laughs] I tell my Republican friends, only half tongue-in-cheek, that although it’s well-known that I’m a Democrat, I guess my clients should be happy that a Republican came in because all the big money we’ve ever made has been under Republican presidencies.”

Perhaps his most famous short bet was exposing the massive fraud at Enron. He also gained notoriety for shorting Tyco International and WorldCom, and before that Baldwin-United. Enron, Tyco and WorldCom occurred during George W. Bush’s administration. Baldwin-United was a Reagan-era trade.

On Wednesday, the Dow broke 21,000 during intra-day trading. The market has continued to climb higher since Donald J. Trump’s election.

In the interview, Chanos was asked if the current market environment reminded him of a previous one. He responded that they’re all different because they each have different driving forces. He did drop a hint of where he’s looking for companies that might get in trouble.

“Since ‘08, ‘09 I think we’re going to look back and say that it was the advent of central banking, ‘the central bank saves the world and makes you all rich’. So, QE and zero interest rates, I suspect we’re going to look back and say well 8 years of that policy kind of got us to where we are now, so how is that going to change if it does, and how does that change manifest itself? Are we going to see companies that just can’t possibly do well if interest rates go up by 400 [basis] points or 300 [basis] points? That’s certainly one thought.”

He continued: “On a macro basis, I mean, I’m not positioning the portfolio because that’s what I think but on the other hand I’m keeping an eye out for companies who might get into additional trouble should that regime be ending. And whether it’s in the auto cycle or companies with really, really low returns on capital that have been using financial engineering to bolster their results, those are sort of the things that we’re interested in right now.”

Capitalize For Kids hosts an investment conference in Toronto that raises funds to support children’s brain and mental health programs. Read the full interview here.

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.

Read more: