Teamworks Investors Bullish on Sports-Targeted Software

Teamworks, a digital software platform designed specifically to help sports teams manage operations, recently raised a $50 million Series D round. No valuation was disclosed. Delta-v Capital led the financing round, and other participants include General Catalyst (GC), Seaport Capital, Teamworthy Ventures, Afia Capital and more than 30 current and former professional athletes (including retired NBA star David Robinson and Falcons QB Marcus Mariota).

For Delta-v and GC, the follow-on investment (GC led Teamworks’ Series B, Delta-v led its Series C) is largely a bet on vertical software as a service (SaaS) and software adoption within sports. “[Delta-v sees] a huge opportunity [for Teamworks] to follow in the footsteps of companies like Procore, Instructure and Tyler [Technologies], and be that system of record for the sports vertical,” said Dan Williams, a partner at Delta-v. Procore, Instructure and Tyler are multibillion dollar publicly traded vertical SaaS businesses within the construction, education and government sectors.

More from Sportico.com

NFL Player Data Market Evolving With Profits and Pitfalls to Match

ICC Cozies Up to U.S. Broadcasters Ahead of Cricket World Cup

Los Angeles Dodgers Peanut-Pitching Vendor Banned From Pitching Peanuts

Teamworks’ existing market leadership position, the opportunity to bolt additional products onto the platform and confidence in the leadership team were also a part of the investment thesis.

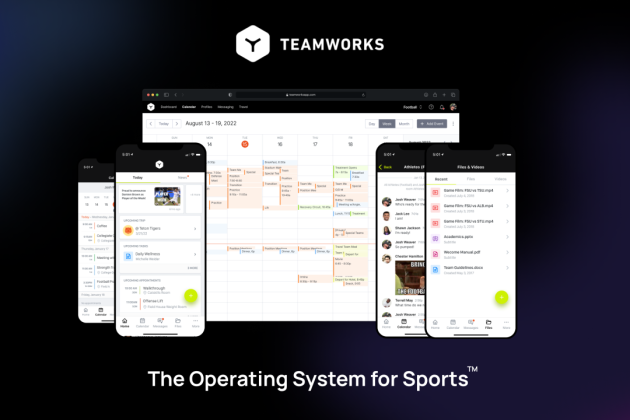

JWS’ Take: Teamworks is emerging as the go-to “operating system for sports” (that’s their tag line). Currently the company serves over 5,000 sports organizations globally, including more than 4,000 collegiate programs, 27 NFL teams, 20 NHL teams, 12 NBA teams and 14 MLB clubs. At its core, Teamworks is a collaboration application.

“[Think of it as] Slack plus Outlook plus Dropbox plus DocuSign,” Williams said. “All the functionality you get in those horizontal applications, but all built purposely for these teams.”

Unlike the horizontal SaaS platforms referenced, which were built to serve a wide array of users, vertical SaaS solutions are custom-tailored with a specific end customer in mind. Zach Maurides, a former Duke football player, founded Teamworks to solve some of the communication-related pain points elite sports organizations were experiencing. He began selling the software solution to college teams during his time in Durham.

Holly Maloney (managing director, General Catalyst) said she’s always gravitated towards industry-specific investing and industries early in their digital transformations—such as sports. “When you back companies that are in these early phases of digital transformation, especially in industries that have some complexity to them, these companies emerge as market leaders,” she said. “There are a lot of advantages that those companies gain from having scale, efficiency and talent that can make them highly strategic assets.”

Delta-v also maintains a strong thesis around vertical SaaS. “A custom suit fits a whole lot better than a suit off the rack,” Williams said.

As a result, vertical SaaS businesses generally enjoy better gross retention rates than their horizontal peers. “They keep their customers [and the recurring revenue] because the customers love their product. It’s built for them,” Williams said. Maloney said Teamworks’ early traction with customers has been “really, really strong, which manifests itself in high retention, which makes it an attractive subscription business model going forward.”

Vertical SaaS businesses also tend to have more capital efficient go-to market strategies and CAC metrics, which makes them attractive from an investment standpoint. “They are really focused on just selling to [customers within the industry], as opposed to trying to sell to every enterprise that exists in the world,” Williams said.

Sports organizations have been slower to integrate technology solutions, particularly on the operational or B2B side, than those verticals. “These organizations have prioritized the business to consumer [experience] because that is what is highly visible to [and expected by] the general population,” Maloney said.

But Williams said organizations have been more frequently using B2B software since the start of the pandemic, when teams began looking for new ways to communicate and engage with their players. Additionally, the ongoing changing of the guard in sports—both on the field and in the front office—is driving adoption of these technology solutions among teams. “The age of coaches and ADs is decreasing, and the expectations of [Gen-Z] athletes as they come out of high school and out of college is changing in terms of how they want to interact and the efficiencies that can be achieved through the adoption of technology,” Williams said.

The Delta-v partner anticipates the percentage that sports teams spend on technology will continue to climb closer to the 3-4% seen in other industries as Teamworks’ product line grows and new solutions are introduced.

As more and more athletes familiar with Teamworks from high school or the college level graduate to the pros, they are looking for the same digital collaboration capabilities to be available. “That has helped to create and accelerate adoption [too],” Williams said.

From a team perspective—at least at the pro level—an investment in technology seems like a no-brainer. “These athletes are worth a considerable amount of money. So, to spend a little bit of money to have a software platform that makes them efficient and ensures they are where they need to be when they need to be there. They have an easy communication channel with coaches and training staff sets them up [for success]. It’s a great investment, ROI to make given [their] value,” Williams said.

Unlike the construction, education and government sectors, the sports industry does not currently have a publicly traded system-of-record platform. Maloney viewed that as an opportunity; in fact, she said if there were an established market leader it would be less exciting to her.

“[I am] excited about where the [sports] market was from a maturity perspective, from a technology adoption perspective and knowing that a platform company was still to be built,” Maloney said. “It [feels] like Teamworks [has] the opportunity to be the organizing principle in the category.”

The absence of an existing platform giant also means there is no larger company to acquire Teamworks, but Williams did not see that affecting an eventual exit. He said the team and board are focused on becoming a public company. “The implication is that there have been these large platforms in Tyler, Instructure and Procore that have proven there’s interest in the public markets for companies like that.”

The company will likely need to reach $150 to $200 million in revenue before it can seriously consider an IPO. It is not clear where the privately held business stands today. But Williams did not expect Teamworks to be filing for an IPO within the next 12 months. FWIW, there are other potential paths to a return on investment for Delta-v and the other investors, including a strategic exit, should an IPO fail to be an option.

Williams called Teamworks’ most recent round opportunistic. He said the company plans to use the funding to build, acquire and integrate additional software solutions into its core platform. “The more [the company] can do to help people along and deliver a package of solutions, the better and the stickier the relationship can be over time and the higher likelihood [the company] can continue to expand within those customers,” Maloney added.

Best of Sportico.com