It’s ‘not necessarily the greatest environment for government bonds’: Strategist

Brian Jacobsen, Multi-Asset Strategist at Wells Fargo Asset Management, joins Yahoo Finance’s Kristin Myers to reflect on the rise in yields and how investors should be reallocating their portfolios amid tech sell-off.

Video Transcript

KRISTIN MYERS: All right, market action right now, again, remains in the red as we see big tech sell off, NASDAQ down about 2 and 3/10 of a percentage point. As we've been talking about investors rotating out of some of those big tech names, we are seeing Tesla taking a huge hit today in the red. You can see right there some of those tech stocks under pressure, Tesla down over 5% right now, Apple down also 2.7%, and Zoom right now down over 5%.

We've got Brian Jacobsen here with us. He's a Wells Fargo Asset Management multi-asset strategist. Brian, always good to have you with us. So let's start with what Jay Powell was talking about today, again, soothing some of these fears around inflation, and yesterday, when talking about the rising bond yields. UBS's Tom McLoughlin said to us that this was transitory, echoing some of what we heard from Powell today. I'm wondering what your thoughts are on this.

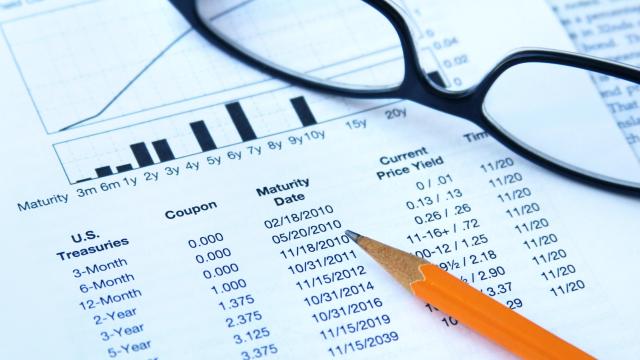

BRIAN JACOBSEN: Yeah, so obviously, there's been quite the move up in yields. And unfortunately, it's been in the yields that are probably most relevant to helping support this economic recovery. Right, a lot of people look at the overnight rate for the federal funds rate, and it's not that relevant to them. But when you see it showing up in the 10-year Treasury yield or mortgage rates, then it becomes real. And you can understand why these move ups in yields can really give some investors a little moment of pause.

But Chair Powell seems to suggest, which we agree, is that the yields have moving up for kind of a good reason. Initially, it was rising inflation expectations. That seems relatively contained. But now it's more because of the better growth outlook. So our big concern is whether or not we have moved up too far, too fast, at least for the market to be able to digest it. Maybe that's why we've had a bit of a pullback in the last couple of days. But as long as we don't go up too much higher than where we are, let's say 1.5% on the 10-year Treasury, it shouldn't really be too much of a headwind for the broader economic recovery.

KRISTIN MYERS: And the 10-year right now holding steady, just below 1.4 now. I see that 1.5 is that level that you got-- that you are giving us right now. What are you thinking in terms of timing either for the markets to kind of digest some of this news as you were saying, or for investors really to go back into the markets and for some of those yields to come down?

BRIAN JACOBSEN: Well, we think that from a time frame perspective here, that it's really about what's next for the Fed, the next speech. Obviously, we'd like it if it was tied to the calendar, as to when their next meeting is. Oftentimes, it's the slip of the tongue that tends to move yields either up or down. If you remember back to 2013 with then chair Ben Bernanke, the famous taper tantrum just because he said in a speech, at some point, we're going to be stopping this asset purchase program not now, not tomorrow, but at some point in the future. And the market sold off on that, yields rose.

We think that the Federal Reserve is going to be very careful in trying to craft and control their messaging around that. So we think that we could see maybe a slow grind higher with yields. Which makes us very optimistic about the outlook for equities. Not necessarily the greatest environment for government bonds, but we think it's actually very good for equities and for the more what are called the credit sensitive parts of the market, like high yield bonds and lower quality investment grade debt.

KRISTIN MYERS: Looking out at equities over the rest of the year, of course, we saw big tech under pressure today, and we've kept hearing that big tech probably isn't going to be leading the market in 2021. So for some of our investors out there, especially some of the folks that really got in during the pandemic, how should they be thinking about reallocating their portfolios in this current environment?

BRIAN JACOBSEN: The way that we're trying to coach our clients and the way that we're managing our clients' money is to really try to pivot more into those parts of the market that have underperformed, not just over the last year, but really, if you think about it, the last, say, five years or even the last 10 years. Is there some maybe valuation catch-up that can happen?

That would be more with what are called the value part of the spectrum. So if you think about, like, financials and industrials, companies that typically trade at lower market multiples-- so the earnings per share relative to their market prices-- those have underperformed over the last 10 years or so. And so those are areas that we find very attractive and should benefit, we think, from a continued economic improvement.

But then there's also a broad net when you look outside of the United States, as far as emerging markets and even in Europe and Japan. And so, for us, we're encouraging clients to continue to sort of lean into those parts of the market that most underperformed because we believe that the economic fundamentals are improving, and that this isn't just some sort of ephemeral one to two-year bounce in growth, that this actually has a lot of legs to it.

KRISTIN MYERS: All right, Brian Jacobsen, Wells Fargo Asset Management multi-strategist, thanks so much-- multi-asset strategist, excuse me-- thanks so much for joining us today.