WWE’s Khan Following Disney’s Lead in Leveraging IP for Growth

Editor Note: JohnWallStreet will be on vacation next week. In his place, the newsletter will deliver a five-part series taking readers inside BSE Global, owners of the Nets and the Barclays Center, among other holdings.

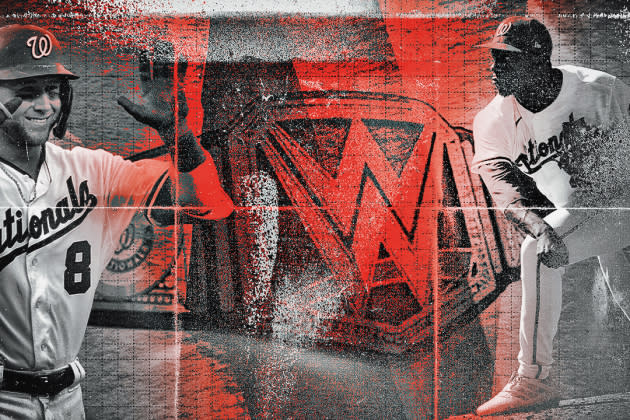

On Wednesday, WWE announced Spotify is now the exclusive home of the company’s audio content—including new podcasts they will develop in partnership with The Ringer (Spotify acquired Bill Simmons’ digital media and podcast outfit in 2020). WWE also announced plans for its second NFT release (featuring John Cena) and disclosed MLB-branded championship title belts will be coming to market in 2022.

More from Sportico.com

Spotify and WWE Ink Exclusive Podcast Deal, The Ringer to Develop New Slate of Wrestling Shows

McKinsey Analysis: Despite Slump, Sports NFTs Aren't Going Away

Leveraging intellectual property to drive revenue is nothing new for the sports and entertainment giant (see: Hasbro figures, Tonka Wrestling Buddies, Technōs WWF WrestleFest). But since president Nick Khan joined the company last August, WWE has worked to monetize its exclusive IP beyond toys, T-shirts and memorabilia. “One of the key reasons for Disney’s success is their unparalleled abundance of intellectual property,” Khan said. “If you look at our intellectual property, which we are quite proud of, it is largely untapped.”

Since April, Khan hired Scott Zanghellini, Alex Varga and Samantha Greenberg, all formerly of CAA, to lead a new revenue strategy and development group focused on expanding the business and reaching new audiences.

Our Take: Historically speaking, WWE’s consumer products segment, which covers licensing, venue merchandise and ecommerce sales, has been a solid revenue driver for the company. According to Wrestlenomics, the segment was responsible for 10% of total revenues in 2019.

The segment has grown since Khan took over. Wrestlenomics indicated both licensing (+20%) and ecommerce revenues (+50%) rose significantly in Q2 2021 over Q2 2019 totals. Since the return of fans, Khan said, “Our in-venue purchases per person are up at least 50% in each and every venue that we’ve been to.”

Khan attributes the increase in venue spending to the decision to “refocus on selling city-specific merchandise” at shows. Winning Streak CEO Chris Lencheski, whose company recently collaborated with the Minnesota Twins and DJ Skee on a sold-out, limited edition in-stadium collection, explained it is a smart approach. “Customers want bespoke product that can only be purchased on site or in the venue,” he said. “The level of interest in these products exceeds the traditional in-venue fare.” Fans at Allegiant Stadium for SummerSlam this Saturday night will have the opportunity to purchase Las Vegas- and Raiders-branded event swag, including a limited edition (only 500 available in-venue) Mr. McMahon Las Vegas T-shirt that will come with a faux billion-dollar bill attached.

WWE’s move to provide fans with the option to order venue merchandise through the WWE app has also helped the company capture sales they may have lost in the past (think: long lines at the souvenir stand).

But WWE’s president believes a “huge growth opportunity” within the consumer products segment remains, as there are a number of new revenue opportunities available to IP rights owners that the company has not yet taken advantage of. “It only made sense to bring in [a team of] executives dedicated to [monetizing] them,” said Khan, CAA’s former co-head of television. He opted for a trio of former colleagues because “agents are inherently sales people.”

Digital collectibles are among the more promising “new revenue” streams Khan cited. In addition to the Cena NFTs dropping this evening, the CEO said WWE is in the process of “finalizing a larger NFT deal with a significant partner.”

Championship belt sales already serve as a meaningful source of revenue for WWE. But Khan thinks the MLB collaboration could open the door to “more deals with third parties,” and help push sales to new heights. Remember, for years the organization has sent customized title belts to NFL, NBA, NHL and MLB champions that have shown up at championship parades. Soon enough, fans of those teams at the parade and watching online will have the chance to buy the same commemorative strap at retail.

Gaming is another industry WWE is “taking a hard look at,” Khan said. The company has proven capable of bringing eyeballs to a gaming app. “We have a significant existing marketing deal with DraftKings, and it is our understanding we have exceeded most, if not all, of the metrics under that deal.” But that is traffic for a free-to-play game. It remains to be seen if WWE can drive sports betting and/or iGaming handle for an operator.

Khan said the company is also currently engaged in “deep conversations” about branded slot machines and lottery games.

As indicated in the name, WWE’s revenue strategy and development group is responsible for more than just growing the top line; it is also in charge of helping the 42-year-old company “introduce our product to whole new, young audience,” Khan said. Zanghellini was credited with bringing Khan the idea to stage a pair of matches at Rolling Loud (a large hip-hop festival that drew a diverse crowd of 250,000 between the ages of 16 and 24). WWE sees aligning with The Ringer as another way to tap into a younger audience.

Best of Sportico.com