TimkenSteel: This Value Stock Is On the Rise

TimkenSteel (NYSE:TMST) is a New York Stock Exchange-traded steel stock taht just hit a new all-time high, and yet it seems to qualify as a value stock. If you thought it was just growth stocks in Silicon Valley that made it to new highs, TimkenSteel is proof that cyclical stocks can still be part of a winning strategy. Lately, value stocks have been on the rise as well.

In business since 1917, the Canton, Ohio-based steel maker is trading with a price-earnings ratio of just 7.21, well below the average price-earnings ratio of the stock market as a whole. In addition, TimkenSteel can purchased relatively cheap, with a price-book ratio of 1.60. The price-sales ratio also suggests value at 0.81, as does the price-to-free-cash-flow ratio at 5.65. The market capitalization is $1.04 billion and the enterprise value is $724.30 million.

The company manufactures alloy steel, including micro-alloy and carbon steel.

The past year's earnings per share were quite good, growing 331.20% year-over-year. Over the past five years, the EPS growth rate is a solid 27.20%.

Its not expected that this years extraordinary results will continue, according to Wall Street analysts. The short float is high at 13.63%; should those shorts be forced to cover, that could fuel a decent rally.

TimkenSteel has no long-term debt. The current ratio is 2.30. The company does not pay a dividend.

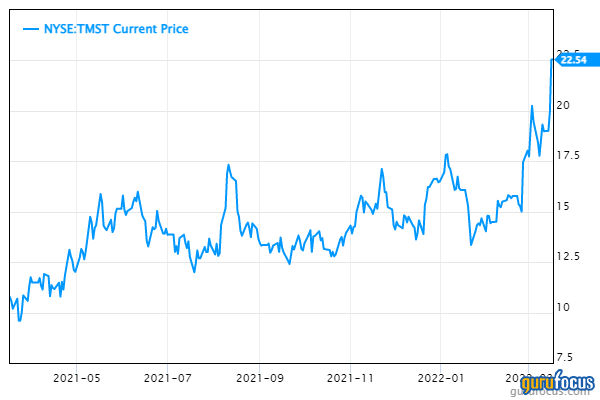

The stock price this year has moved from $15 in January to this weeks new high of $22.50 thats a significant gain in a very short period of time. Heres how the TimkenSteel daily price chart looks:

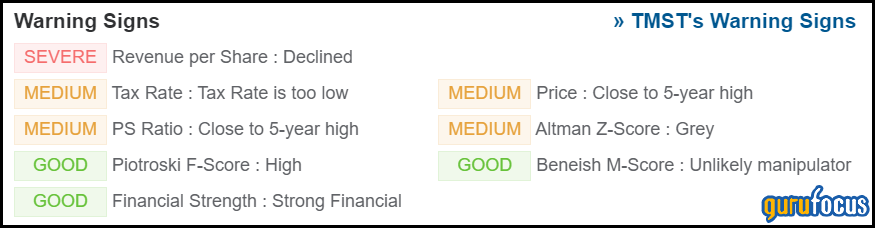

The GuruFocus summary of financials for TimkenSteel finds three good signs, four medium warning signs and one severe warning sign:

This weeks new high indicates how much TimkenSteel investors approve of the companys recent performance and the potential for future growth as the steel market remains hot.

This article first appeared on GuruFocus.