NBA's small-market franchises finding road to success can be an obstacle course

The big market-small market tension that exists in the NBA played out publicly and privately last week.

Atlanta Hawks coach Nate McMillan said the league needs and wants the New York Knicks in the playoffs. The NBA fined him $25,000 for “detrimental public comments asserting bias.”

The morning after the Los Angeles Lakers beat the Golden State Warriors in a play-in game, a small-market front-office executive watched ESPN. As he told the story, back-to-back segments aired on the Lakers-Warriors game, then highlights from other sports, a small snippet about Memphis-San Antonio – the other play-in game from the night before – then more Lakers-Warriors leading into the next show, which started its program with Lakers-Warriors.

The executive isn’t naïve. He knows LeBron James-Steph Curry is the top story. But, he wondered, couldn’t Spurs-Grizzlies get just a little more love from the network that televised the game?

Those are just two examples – anecdotal and conjecture – of the plight small-market teams face. But it goes deeper than that.

With the first round of the playoffs underway, Utah, Milwaukee, Denver and Portland carry the small-market flag. All four are legitimate contenders to reach the Finals, with Utah at the No. 1 overall seed, Milwaukee No. 3 in the Eastern Conference, and Denver No. 3 and Portland No. 6 in the Western Conference.

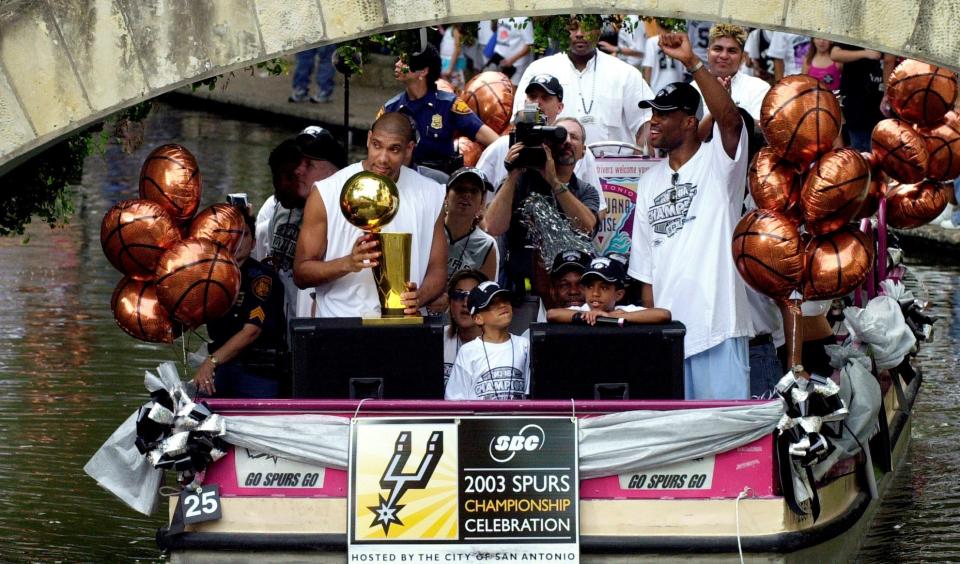

Regardless of their regular-season finish, the odds are not in their favor. Since 1989, just three small-market franchises have won a championship – San Antonio five times, Detroit three times and Cleveland once. Portland, Utah, Indiana and Orlando reached the Finals but did not win.

Yes, Miami won titles, and it qualifies as a mid-market team, but the conversation requires nuance. The NBA doesn’t care for big market or small market labels. By TV market size, Minneapolis-St. Paul, Detroit and Denver are bigger than Miami-Ft. Lauderdale, according to Nielsen data, and no one would say the three former regions are more attractive than the latter.

Not all big markets are created equal either.

The conversation about markets goes beyond revenue generated – though that is important and can help deep-pocketed teams correct mistakes easier than teams that don’t generate as much revenue – and is often about location, revenue, free agency and luck.

NBA's coastal elites

The definition of big market in the NBA needs to be reframed not only by TV size and revenue but by location. Geography matters. The coastal cities have an advantage: Los Angeles, Golden State, New York and Miami.

Some executives have called those “glamour markets” to separate teams from other large markets that don’t have the same appeal to players. See Atlanta and Washington, D.C. – two large markets that have struggled attracting free agent.

Within that discussion, there are caveats. The New York Knicks didn’t capitalize for the better part of two decades despite location and money to spend. The same can be said for the Los Angeles Clippers, but that’s no longer true with Steve Ballmer owning the team. And the Knicks, as viewed by executives around the league, are ready to take off with a new front office led by Leon Rose, a new coach in Tom Thibodeau and a promising roster led by Julius Randle and R.J. Barrett.

In 2018-19, the Brooklyn Nets were a decent team – the No. 6 seed and two games above .500. They were not headed for a championship with a roster led by D'Angelo Russell and Spencer Dinwiddie. But general manager Sean Marks cleared salary cap space and acquired Kyrie Irving and Kevin Durant.

The Los Angeles Lakers went five consecutive seasons without making the playoffs. That didn’t stop LeBron James from joining a team that didn’t win more than 35 games in those five seasons.

In free agency, it's location, location, location

Location ties into free agency. For four seasons, the Bucks dealt with the fascination surrounding Giannis Antetokounmpo’s potential free agency in the summer of 2021. To which glamour market would Antetokounmpo flee? Luckily for the Bucks, Antetokounmpo signed a 5-year, $228 million contract extension to remain in Milwaukee.

New Orleans is dealing with a similar situation regarding Zion Williamson two years before he becomes a restricted free agent. Even though Utah’s Donovan Mitchell just signed a lucrative extension, you can be sure there are execs around the league plotting for his free agency. Conversely, no one is speculating about Knicks guard R.J. Barrett’s free-agent possibilities.

In 2019, Kawhi Leonard left the Toronto Raptors – coming off a championship – for the Los Angeles Clippers. Durant and Irving headed to Brooklyn. Kemba Walker bolted Charlotte for Boston, and Jimmy Butler shed Philadelphia for Miami. To be fair, Khris Middleton re-upped with Milwaukee, ensuring the Bucks had another All-Star alongside Antetokounmpo.

And while Anthony Davis was not a free agent, he finagled his way out of New Orleans to the Lakers in a trade in 2019 and re-signed with the Lakers in 2020.

Gordon Hayward, who originally left Utah for Boston, was a rare situation of the reverse happening. Hayward departed Boston and signed with Charlotte. But Charlotte paid the price for one of the top free agents available: the Hornets had to overpay, signing Hayward to a 4-year, $120 million deal.

Finding luck in the draft

Some GMs believe small-market success requires more luck. Antetokounmpo, a generational player, was drafted No. 15. Denver didn’t select All-Star center and potential 2020-21 MVP Nikola Jokic until the second round in 2014, and Utah took Donovan Mitchell with the No. 13 pick (2017) and Rudy Gobert at No. 27 (2013).

San Antonio, the NBA’s premier small-market franchise over two decades, won five titles. They drafted well and also were lucky. David Robinson sustained a fractured left foot in 1996-97, and the Spurs finished 20-62. They won the draft lottery and selected Tim Duncan in 1997. Manu Ginobili was selected at No. 57 (1999), and Tony Parker at No. 28 (2001).

Executives get credit for the picks but finding some of those players where they did in the draft is not the norm.

Big-market GMs also have to have success in the draft. But they also benefit from top players wanting to play in their city.

A commitment to winning

The price for small-market teams is steep. Of the past 14 NBA champions, 10 were luxury-tax payers – meaning their team salary surpassed a specified amount and had to pay a tax.

The Cleveland Cavaliers paid $54 million in luxury taxes after winning the NBA title in 2015-16 and reportedly lost tens of millions of dollars that year.

While most owners say they will pay the luxury tax if they have a championship contender, there is a cost-benefit analysis where winning and making money/losing money intersect and owners decide what price they are willing – or not willing – to pay.

Right now, Bucks ownership is committed to winning. While the Bucks won’t surpass the luxury tax this season, they have a high payroll that likely will climb next season when extensions for Antetokounmpo and Jrue Holiday kick in.

To build a championship-caliber roster around Antetokounmpo, the Bucks not only had to spend money, they spent draft picks. Milwaukee has traded its first-round picks in 2021, 2023, 2025 and 2027.

Denver will be an interesting test case to follow, too. Ownership – the Kroenke family – has not paid the luxury tax since 2009. But Jokic is a free agent in 2023, Michael Porter Jr. is a restricted free agent in 2022 and Aaron Gordon is a free agent in 2022. The Nuggets will have financial decisions to make that will impact the team’s championship aspirations.

Memphis also will be interesting to watch. The Grizzlies have a solid young team led by Ja Morant. Beyond internal player development, how do they get better? Will a premier free agent join up with Morant? The more likely options? Hitting on another draft pick and/or trades.

Of the 10 teams that have paid the most in luxury taxes since 2002, according to Spotrac data, seven are in major and/or coastal markets: New York, Dallas, Brooklyn, Los Angeles Lakers, Golden State and Miami. The other three are Cleveland, Oklahoma City and Portland.

The NBA market dynamic will remain. Building a consistent winner in a smaller market is possible but just more difficult.

SUBSCRIBE: Help support quality journalism like this.

This article originally appeared on USA TODAY: Small-market NBA teams finding road to success filled with obstacles