Apple's buy now, pay later plan launches, allowing users loans for purchases

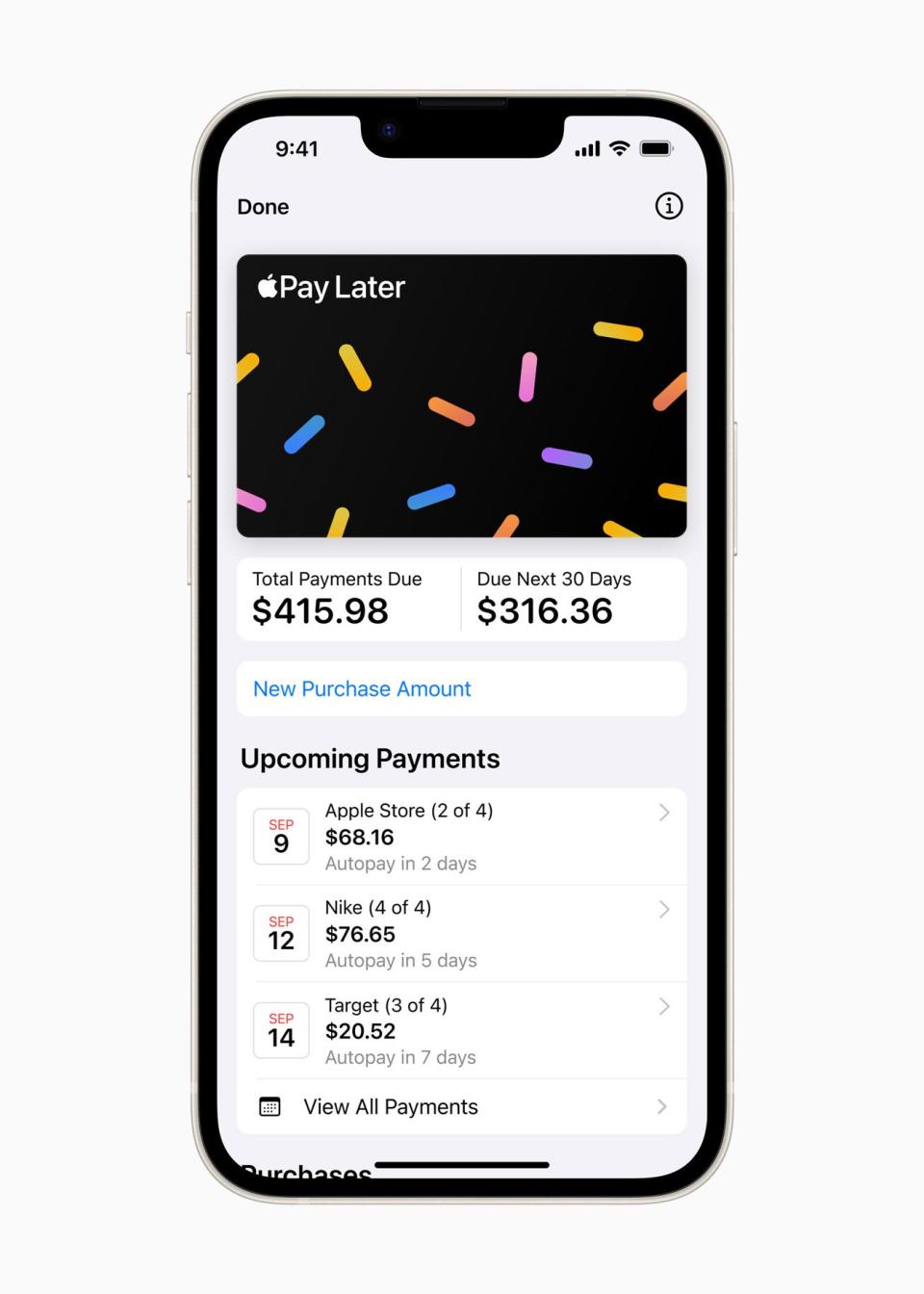

Apple launched Tuesday Apple Pay Later, a buy now, pay later feature that allows users to split purchases into four payments over the course of six weeks.

For now, the service will be available only to randomly selected users who will get early access to a prerelease version of Apple Pay Later. Apple plans to offer the feature to all eligible users "in the coming months."

"Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions," Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, said in a statement.

Apple's iOS 16.4 is out now: These are all the new emojis available on your iPhone

Buy now, pay later apps are beloved: Should users be worried about high debt?

How do I use Apple Pay Later?

Apple Pay users will be able to apply for Apple Pay Later loans of $50 to $1,000, which can be used for online and in-app purchases on their iPhone or iPad.

To get started, users can apply for a loan within the Wallet app on iOS. They will then be prompted to enter the amount they want to borrow and agree to the Apple Pay Later terms.

A 'soft' credit check will be done as part of the application process, Apple said, and once approved, the user will see the Pay Later option when they select Apple Pay at checkout. Users can track and manage Apple Pay Later loans in Wallet, and they will receive notifications via the app and email before payments are due.

Apple Pay Later is enabled through the Mastercard Installments program, and payments have no interest and no fees, the tech giant said.

Buy now, pay later programs

Buy now, pay later programs such as Klarna, Afterpay and Affirm have grown in popularity in recent years. The services allow consumers to make purchases and pay them over time after an initial payment.

Apple announced its Pay Later service last year, promising "a seamless and secure way to split the cost of an Apple Pay purchase."

This article originally appeared on USA TODAY: Apple Pay Later launches, allowing users to buy now but split the cost