Birkenstock is taking a last stand for brand control in the age of Amazon

Birkenstock is becoming the face of the Amazon resistance.

The German sandal brand, whose contoured, cork-cored footbeds have attracted generations of customers, has become maybe the biggest and loudest critic of the ecommerce steamroller. Last year, Birkenstock USA decided to pull all its products from Amazon, saying the large number of counterfeit Birkenstocks on the site were hurting its brand. Now David Kahan, CEO of Birkenstock USA, is attacking an Amazon program that involves the company buying products from third-party retailers at full price and reselling them itself, apparently with or without the consent of the brands whose products are involved.

“Pathetic” is how Kahan described the program (pdf) in a letter to Birkenstock’s retail partners last week obtained by the Washington Post. “Amazon can’t get Birkenstock by legitimate means so why not dangle a carrot in front of retailers who can make a quick buck,” Kahan wrote. Evidently, among the retailers Amazon contacted were those selling Birkenstock footwear. In a July 25 interview with the Post (paywall), Kahan went on to call the practice “modern-day piracy” and “a middle finger to all brands, not just Birkenstock.”

The program launched in Europe last year. Its goal is to let Amazon offer shoppers a more complete product catalogue. Since Amazon is buying at full price, it likely isn’t making money on the sales, but then market share has always taken priority over profit at the company.

The program also adds to the difficulties brands face in maintaining control of how their products are priced, and of their carefully tended reputations and brand images. The general feeling in retail is that the landscape has shifted dramatically with the growth of ecommerce. Previously, brands and retailers had more control over pricing and how consumers experienced products, since shoppers had to actually go to stores to find items, get information, and compare prices. But the internet has created a free flow of information where shoppers can research products and find the lowest prices, even across different geographies, within minutes. Amazon embodies this shift.

As it gobbles up retail market share and adds new Prime members in droves, pressure is increasing on companies to sell on the site. Many are hesitant, however. Amazon’s focus on low costs, efficiency, and convenience lump a brand’s authorized products in with those peddled by third-party sellers, some of whom may be unauthorized to sell the products and could be selling fakes.

Brands are forced into a difficult position. Generally speaking, they can either try to keep their products off Amazon, or work with it in the hope their cooperation will give Amazon more motivation to police what’s on its marketplace.

Birkenstock ultimately opted to cut ties with the retailer, and has made clear it will not tolerate its retail partners selling to the site either. In his letter about Amazon’s new program, Kahan wrote, “I will state clearly, any Authorized retailer who may do this for even a single pair will be closed FOREVER. I repeat, FOREVER.”

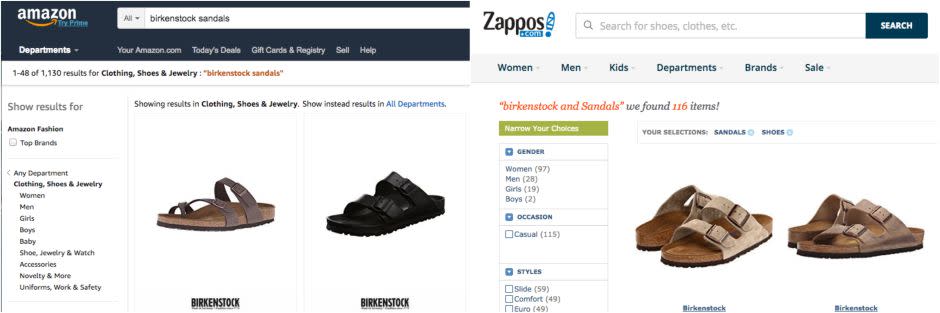

But keeping products off Amazon is challenging. Amazon still has plenty of Birkenstocks for sale, as does its subsidiary Zappos. A July 26 Google search for Birkenstock even brought up a Zappos ad to prompt customers to buy the brand on its site.

For sale, whether Birkenstock likes it or not.

When contacted, Birkenstock said that it has no further comment at this time. Amazon did not reply to a request for comment.

Faced with a similar scenario, Nike is trying the opposite approach. It was a longtime holdout from selling directly on Amazon, despite the fact that Morgan Stanley estimated it was still the most-sold apparel brand on the site. Recently, however, Nike announced a small pilot program to sell start selling a limited number of items on Amazon.

Amazon, in exchange, reportedly offered to crack down (paywall) on Nike counterfeits and limit sales of Nike products by unsanctioned third-party sellers. In a conference call with investors in June, Nike CEO Mark Parker said, “As we do with all of our partners, we’re looking for ways to improve the Nike consumer experience on Amazon by elevating the way the brand is presented and increasing the quality of product storytelling.”

Brands that may not love the way their products are sold on Amazon have to decide whether to fight Amazon or engage with it. In the meantime, Amazon is only getting bigger.

This story has been updated to correct the name of the new Amazon program. It has no official name yet.

Sign up for the Quartz Daily Brief, our free daily newsletter with the world’s most important and interesting news.

More stories from Quartz: