Pros and Cons of Getting a Deed in Lieu of Foreclosure

When you get behind on your mortgage payments, you potentially risk losing your home to foreclosure, which will result in a host of negative complications for you, your credit and your ability to finance another home in the near future. One option that can help you avoid the foreclosure process is a deed in lieu of foreclosure. Although the terms for both foreclosure and deed in lieu of foreclosure result in you no longer having the title to your home, the two options involve different processes and have different results.

Here's what you need to know about the pros and cons of opting for a deed in lieu in order to save your home from foreclosure.

What Is a Foreclosure?

A foreclosure is a legal process used by a lender to obtain ownership of a home when a homeowner fails to make payments and defaults on the mortgage. In general, lenders initiate foreclosure three to six months after your first missed payment. A foreclosure can often be avoided, however, even if the homeowner has already received a foreclosure notice.

Types of Foreclosure

A foreclosure can be supervised by the court, which is known as a judicial foreclosure. The lender files a civil lawsuit against the borrower and initiates the foreclosure process, which can take up to eight months to conclude.

When a foreclosure is not supervised by the court, it's known as a nonjudicial foreclosure and can take up to one year. In either case, the lender will ultimately place the house on the sales market.

What Is a Deed in Lieu of Foreclosure?

A deed in lieu of foreclosure — aka mortgage release — involves the homeowner voluntarily surrendering the home's title to the lender that holds the mortgage. As soon as you transfer the title of your home back to your lender, the foreclosure process will stop.

The deed in lieu of foreclosure process usually takes about 90 days to complete. You might want to consider a deed in lieu if you received a notice of default from your lender or owe more on your home than what it's worth.

Other reasons to consider this option are if you have unsuccessfully tried to sell your home to cover your mortgage balance and don't qualify for options to stay in your home such as a forbearance, short sale, modification or reinstatement.

Deed in Lieu of Foreclosure Eligibility

You must meet requirements to be eligible for a deed in lieu: No liens must be in effect against the house and the bank can't have already begun the foreclosure process. Check with your lender as soon as possible to determine your options. Here are the pros and cons of getting a deed in lieu of foreclosure:

Pro No. 1: You Might Be Eligible for Relocation Assistance

Not having to go through the foreclosure process is an advantage for your lender because it saves a considerable amount of time and effort. As a result, the lender might be willing to give you some cash to incentivize you to leave the property in a timely manner and in good condition. Depending on the lender, you might be eligible for up to $3,000 to help you with moving expenses.

Pro No. 2: You Might Be Able to Finance Another Home Sooner Than You Think

Although a deed in lieu of foreclosure stays on your credit report for up to seven years as a debt that was settled for less than what was owed, the impact of a deed in lieu on your ability to finance another home might not be as lasting. In fact, you might be able to qualify for a conventional mortgage via Fannie Mae within two years of the completion of a deed in lieu.

Pro No. 3: You Might Be Able to Save Money

Opting for a deed in lieu could also save you money. You might be able to negotiate to have the lender to agree not to pursue what is known as a payment of deficiency, which is the difference between the property's value and debt you owe. Even if the lender agrees not to pursue the deficiency, you'll still owe taxes on the amount the lender forgives.

Con No. 1: You’ll Lose Your Home’s Title

A deed in lieu of foreclosure results in you no longer owning title to your home and losing the right to live in your home after a certain time limit.

For example, after surrendering the title of your home to your lender, you might have to vacate the house immediately, or you might be able to stay in the house for up to three months without paying rent or lease the house for up to one year at current market rates. Ultimately, the amount of time you will have to move out will depend on the lender.

Find Out: Here's What Happens When You Default on a Mortgage Loan

Con No. 2: Forgiven Debt Has Tax Implications

Generally, when a debt of $600 or more is forgiven or canceled by a creditor — including a mortgage lender — you'll owe income taxes on the amount of that debt, according to federal tax law. The exception to this rule was the Mortgage Forgiveness Debt Relief Act of 2007, which applied to up to $2 million of mortgage debt that was forgiven from 2007 to 2016.

Because that act is no longer in effect, you'll have to report the amount of the loan that was forgiven by your lender on your tax return and pay the required income taxes on the amount. You could potentially owe thousands of dollars in taxes depending on how much debt is forgiven.

Up Next: 6 Best Lenders for Bad Credit Home Loans

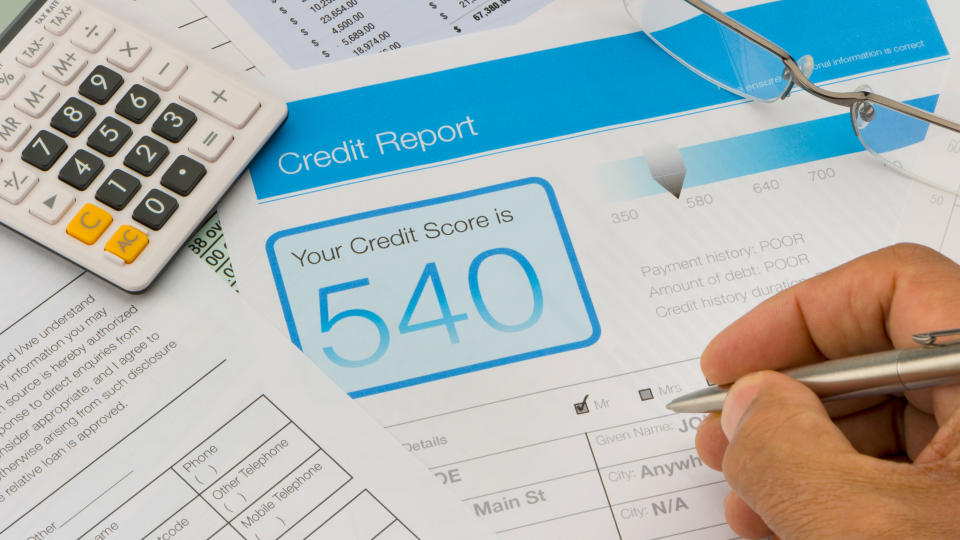

Con No. 3: Your Credit Will Suffer

Your credit will be impaired, with the deed in lieu staying on your credit report for up to seven years. In addition, with a deed in lieu of foreclosure, you can expect your overall credit score to drop anywhere from 50 to over 100 points according to information on Credit Sesame, which provides free credit scores and monitoring.

During the time that your credit is impacted, you'll find it difficult to obtain credit for items you need or want — and when a lender does agree to grant you credit it will likely be at very high rates.

Keep Reading: 7 Steps to Prevent Mortgage Default When You Lose Your Job

This article originally appeared on GOBankingRates.com: Pros and Cons of Getting a Deed in Lieu of Foreclosure