One picture explains a major problem with the Republican tax plan

Win McNamee / Getty

House Republicans passed their version of the Tax Cuts and Jobs Act on Thursday.

It's the first step toward overhauling the US tax code — something President Donald Trump says he wants by Christmas.

Before the vote, House Speaker Paul Ryan emphasized how middle-class Americans would benefit from the plan.

It's true that most Americans will see a tax cut if the plan becomes law, but it's not as sweeping as Republicans make it sound.

House Republicans passed their massive tax bill on Thursday.

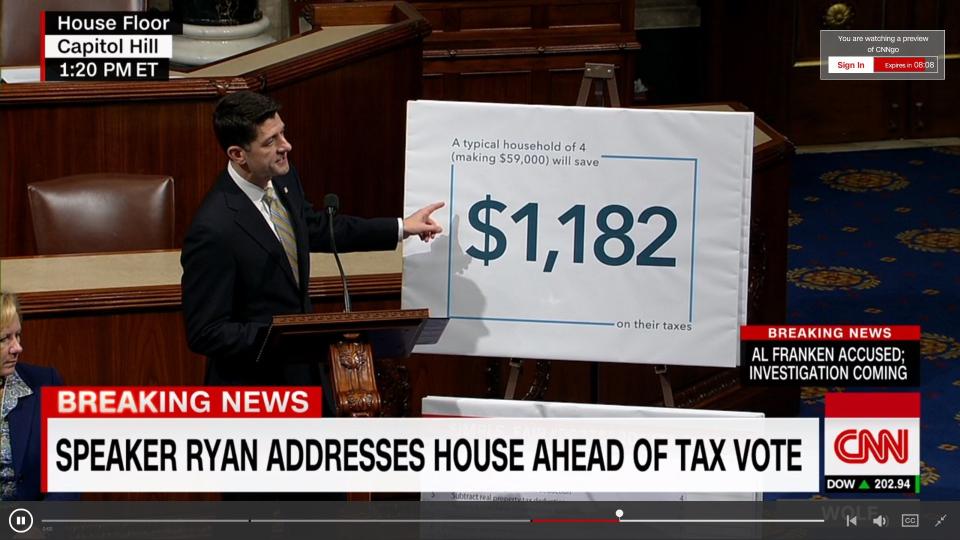

Before the vote, House Speaker Paul Ryan emphasized how middle-class Americans would benefit from the tax plan. He even bought a prop.

Ryan pointed to a white sign with "$1,182" written in large blue numbers. That amount has been a rallying cry used by Republicans since the House's bill, the 429-page Tax Cuts and Jobs Act, was introduced two weeks ago.

A family of four with a household income of $59,000 will save $1,182 if the GOP's tax plan becomes law. That sounds great, right?

CNN

Here's the problem: It may be a tax cut, but it's not exactly sweeping.

It breaks down to less than $100 a month for a hard-working, middle-class family. That's not enough for a home renovation or a vacation, let alone enough to make up for the large retirement-savings gap in the US.

Meanwhile, wealthy Americans, including President Donald Trump, stand to benefit handsomely from the tax plan, thanks to proposals to eliminate the estate tax and the alternative minimum tax, among others.

During a press conference last week, Ryan said, "This is about actually improving people's lives and making a positive difference."

We previously calculated how the GOP's tax plan could affect take-home pay for a single, childless taxpayer who claims the standard deduction, as well as a family of four with two kids under 17.

It's true that most Americans will see their take-home pay increase if Republicans succeed in overhauling the US tax code. But the bigger question is whether $1,182 is enough to make a difference in their financial security.

As a certified financial planner who works with many middle-class Americans, I have my doubts.

NOW WATCH: Here's how to figure out exactly how your take-home pay could change under Trump's new tax plan

See Also:

How your tax bracket could change in 2018 under Trump's tax plan, in 2 charts

A crucial line in Trump's new tax plan will make it a lot harder to buy a $1 million home

SEE ALSO: 7 ways rich people could benefit from Trump's new tax plan

DON'T MISS: Here's what Trump's new tax plan means if you're making $25,000, $75,000, or $175,000 a year