November Dividend Stock Picks

A great investment for income investors with a long time horizon is in dividend-paying companies like Macy’s. Dividend stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. A sizeable part of portfolio returns can be produced by dividend stocks due to their contribution to compounding returns in the long run. Today I will share with you my best paying dividend shares you should be considering for your portfolio.

Macy’s, Inc. (NYSE:M)

Macy’s, Inc., together with its subsidiaries, operates stores, Websites, and mobile applications. Founded in 1830, and currently headed by CEO Jeffrey Gennette, the company size now stands at 140,000 people and has a market cap of USD $6.20B, putting it in the mid-cap group.

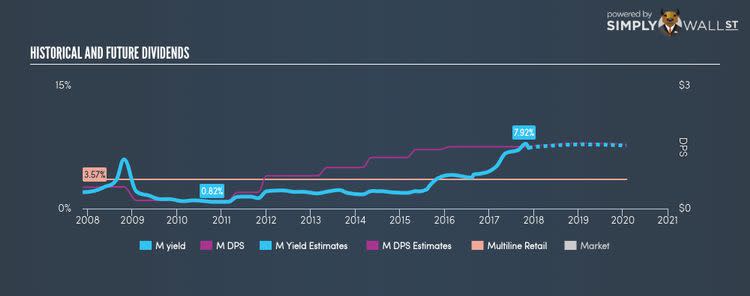

M has a substantial dividend yield of 7.42% and the company currently pays out 66.15% of its profits as dividends . Despite some volatility in the yield, DPS has risen in the last 10 years from $0.52 to $1.51.

SCANA Corporation (NYSE:SCG)

SCANA Corporation, through its subsidiaries, engages in the generation, transmission, distribution, and sale of electricity to retail and wholesale customers in South Carolina. Started in 1924, and headed by CEO Kevin Marsh, the company size now stands at 5,910 people and with the company’s market capitalisation at USD $6.20B, we can put it in the mid-cap category.

SCG has a great dividend yield of 5.64% and pays 76.61% of it’s earnings as dividends . SCG’s dividends have increased in the last 10 years, with DPS increasing from $1.76 to $2.45. To the enjoyment of shareholders, the company hasn’t missed a payment during this period.

People’s United Financial, Inc. (NASDAQ:PBCT)

People’s United Financial, Inc. operates as the bank holding company for People’s United Bank, National Association that provides commercial banking, retail banking, and wealth management services to individual, corporate, and municipal customers. Founded in 1842, and currently headed by CEO John Barnes, the company employs 4,961 people and with the company’s market capitalisation at USD $6.17B, we can put it in the mid-cap group.

PBCT has a good dividend yield of 3.80% and pays 75.08% of it’s earnings as dividends . PBCT has increased its dividend from $0.5332 to $0.69 over the past 10 years. They have been dependable too, not missing a single payment in this time.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.