A handful of stocks are boosting hedge fund returns, but it's not enough

Hedge fund performance benefitted from bets on high-flying tech stocks like Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX), and Alphabet (GOOGL), collectively known as the “FAANG” stocks.

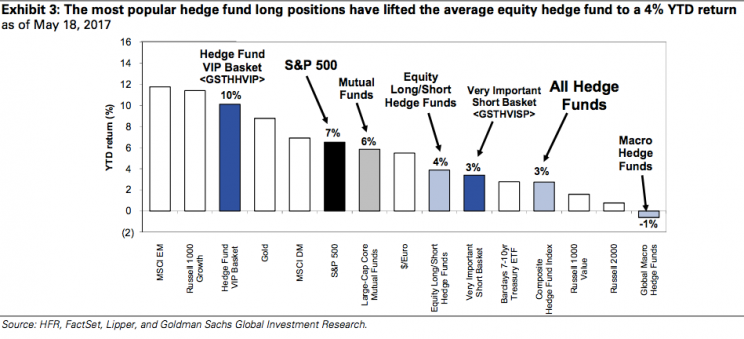

According to a new report from Goldman Sachs Investment Research, Facebook, Amazon and Alphabet were the three most widely-held stocks in the hedge fund industry; Apple was the sixth most popular stock. The firm noted that in the first quarter, a basket of the 50 most popular hedge fund holdings outperformed the S&P 500 (^GSPC), with the former returning 10% and the latter gaining 7%.

While the outperformance of these popular long positions has boosted returns for some hedge funds, the industry continues to trail the S&P 500. The average long/short equity hedge fund has returned 4% year-to-date, while the average macro hedge fund fell 1%. Across all strategies, the average fund is up 3%.

Goldman’s report looked at 821 hedge funds with $1.9 trillion in gross equity positions, including $1.3 trillion long and $647 billion short.

Tech stocks have also boosted the performance of the major market indices like the S&P 500 and the Nasdaq. Apple, Google, Facebook, Amazon, and Microsoft (MSFT) have accounted for 40% of the S&P 500’s entire gains year-to-date, the report notes.

Big names in ‘FAANG’

Among the “FAANG” stocks, there are some big-name hedge funds holding many of them.

Facebook’s largest hedge fund shareholders include “Tiger cubs,” or funds managed by proteges of Julian Robertson: Andreas Halvorsen’s Viking Global, Philippe Laffont’s Coatue Management, Steve Mandel’s Lone Pine Capital, Lee Ainslie’s Maverick Capital, and John Griffin’s Blue Ridge Capital. Daniel Loeb’s Third Point and Zachary Shreiber’s Pointstate Capital are also shareholders.

Amazon’s top hedge fund holders include Chase Colemans’ Tiger Global Management, Viking Global, Coatue, Blue Ridge, and Pointstate.

Apple’s big shareholders include David Einhorn’s Greenlight Capital, Larry Robinson’s Glenview Capital, and Coatue Management. Julian Robertson’s Tiger Management and Loeb’s Third Point sold their entire stakes in Apple during the first quarter.

Viking Global and Coatue are also large shareholders of Netflix.

Viking Global, Glenview Capital, Third Point, Pointstate, and Blue Ridge are also big shareholders in Alphabet, Google’s parent company.

The great fee debate

Naturally, when hedge funds underperform relative to the S&P, it renews the age-old debate about hedge fund fees.

Hedge funds are known to charge investors fees known as “2-and-20”, meaning 2% of assets and 20% of profits. Those fees can vary with some being lower and others being as high as 3% and 30%

Earlier this month, Warren Buffett ripped into the hedge fund compensation structure during Berkshire Hathaway’s annual shareholder meeting.

“In all the professions there is value added by the professionals, as a group, compared to doing it yourself. In the investment world, that isn’t true,” Buffett said.

Instead of hedge funds, Buffett recommends that both large and small investors put their money in low-cost index funds, like those offered by Jack Bogle’s Vanguard.

Some would argue that with nearly 10,000 hedge funds and many of them employing a variety of very different strategies (long/short, credit, risk arbitrage, macro, etc.), they’re particularly difficult to benchmark and often inappropriate to compare to the S&P. There can be some significant dispersion of returns among strategies and even within the same strategies.

Still, some hedge funds will deliver the performance clients are looking for, and as such investors will continue to keep the industry alive.

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.

Read more: