Jazz Pharma (JAZZ) Beats on Q2 Earnings & Sales, Raises View

Jazz Pharmaceuticals JAZZ delivered adjusted earnings of $3.71 per share for the second quarter of 2020, which beat the Zacks Consensus Estimate of $3.38. However, earnings were down 8.4% from the year-ago figure of $4.05 per share.

Total revenues in the reported quarter rose 5.3% year over year to $562.4 million and beat the Zacks Consensus Estimate of $506.43 million.

Following the encouraging results and the guidance raise, shares were up 2.7% in after-hours trading on Tuesday. This year so far, Jazz’s shares have declined 26% compared with the industry’s decrease of 4.3%.

Quarter in Detail

Net product sales increased 6.6% from the year-ago quarter to $558.2 million on the back of growth in Xyrem, Sunosi and Erwinaze net sales, partially offset by a decrease in Defitelio and Vyxeos sales.

Royalties and contract revenues declined 60.5% to $4.2 million in the quarter.

Sales of Xyrem, approved to treat cataplexy and excessive daytime sleepiness (“EDS”) in children and adults with narcolepsy, rose 8.1% year over year to $446.8 million. Sales were driven by 5% rise in bottle volume growth. The average number of active Xyrem patients increased 3%. Beginning mid-March, Jazz noticed a decline in new patient enrollments for Xyrem, following the coronavirus outbreak. However, the trend reversed in the latter half of the second quarter.

Jazz’s newest drug Sunosi recorded sales of $8.6 million in the quarter, higher than $1.9 million in the previous quarter. Sales reflected lower gross-to-net deductions and 12% increase in prescriptions compared to the first quarter of 2020.

Sunosi was approved for excessive sleepiness in narcolepsy & obstructive sleep apnea in the United States in March 2019 and launched in July. It was approved in Europe in January this year with had a rolling launch in Germany in May.

Erwinaze/Erwinase (for acute lymphoblastic leukemia [“ALL”]) revenues were $32.7 million, up 18.3% year over year. The drug’s availability continues to be impacted by ongoing supply and manufacturing issues.

Defitelio sales declined 7.3% year over year to $42.7 million in the quarter. The sales decline reflects reduction in the number of hematopoietic stem cell transplants performed due to COVID-19. Please note that Defitelio product sales vary from quarter to quarter in both the United States and EU because Defitelio treats an ultra-rare acute condition — hepatic veno-occlusive disease.

Acute myeloid leukemia drug, Vyxeos generated sales of $26.6 million, down 15.3% from the year-ago period. Restrictions due to COVID-19 hurt Vyxeos’ demand in the United States.

Other product sales declined 83.5% to $0.9 million.

Adjusted selling, general and administrative (SG&A) expenses rose 9.3% to $170.4 million due to higher expenses for business expansion and preparation for multiple product launches.

Adjusted research and development (R&D) expenses increased 26.1% to $71.3 million, primarily due to escalating expenses related to development of the company’s pipeline.

2020 Guidance

The company raised its financial guidance for 2020 based on strong performance of its drugs during the second quarter, following a cut announced on the first quarter earnings call.

The company expects 2020 earnings in the range of $11.90-$13.00 compared with the prior expectation of $11.25-$12.50. Total revenues are expected to be in the range of $2.23-$2.33 billion versus $2.12-$2.26 billion expected previously.

Total product sales are anticipated in the range of $2.21-$2.31 billion versus $2.11-$2.24 billion expected previously. Instead of providing guidance for individual products, Jazz provided revenue guidance for its two therapeutic areas — Neuroscience and Oncology. While Neuroscience franchise comprises Xyrem, Sunosi and Xywav, Oncology franchise includes Erwinaze, Defitelio, Vyxeos and Zepzelca.

Neuroscience sales are expected in the range of $1.73 billion to $1.8 billion versus the previous range of $1.65 billion to $1.74 billion. The Oncology franchise is expected to record sales of $445 million to $525 million compared with the previous range of $420 million to $510 million.

While adjusted SG&A expenses are anticipated in the range of $700 million to $750 million (same as previous), adjusted R&D expenses are expected to be in the band of $275 million to $305 million (previously $250 million to $280 million).

Pipeline Update

Jazz developed Xywav (JZP-258), a low sodium formulation and a Xyrem follow-on product, to treat EDS and cataplexy in narcolepsy patients. The drug received approval from the FDA last month. Please note that the drug’s label does not contain warning to prescribers, like Xyrem related to sodium content.

The drug is currently being studied for Idiopathic hypersomnia or IH in a phase III study. Top-line data from the study is expected in the fourth quarter, followed by a submission of regulatory application to the FDA seeking label expansion in IH patients as early as the first quarter of 2021.

Apart from Xywav, the company also received FDA approval for Zepzelca (lurbinectedin) in June for the treatment of adult patients with metastatic small cell lung cancer (SCLC) with disease progression on or after platinum-based chemotherapy. The company launched the drug in the U.S. market last month.

Jazz is currently developing JZP-458 in a pivotal phase II/III study for the treatment of ALL and lymphoblastic lymphoma. Jazz plans to submit a biologics license application to the FDA for JZP-458 by the end of 2020.The company plans to initiate a phase IIb study early next year on another pipeline candidate, JZP-385, as a potential treatment for essential tremor.

The company expects top-line results from the phase II proof-of-concept study evaluating Defitelio for prevention of acute graft-versus-host disease in late 2020.

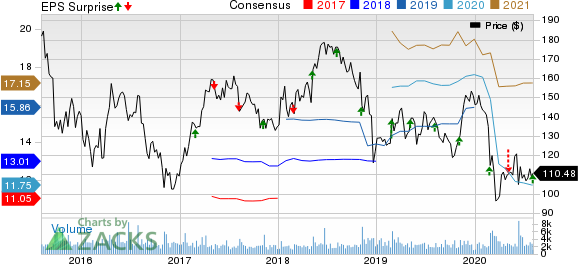

Jazz Pharmaceuticals PLC Price, Consensus and EPS Surprise

Jazz Pharmaceuticals PLC price-consensus-eps-surprise-chart | Jazz Pharmaceuticals PLC Quote

Zacks Rank & Stocks to Consider

Jazz currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks from the biotech sector include Emergent Biosolutions Inc. EBS, Horizon Therapeutics HZNP and Unum Therapeutics Inc. UMRX, all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Emergent Biosolutions’ earnings per share estimates have moved up from $3.45 to $3.58 for 2020 in the past 30 days. The company delivered an earnings surprise of 127.41%, on average, in the last four quarters. The stock has risen 145.7% so far this year.

Horizon Therapeutics’ earnings per share estimates have increased from $1.78 to $2.00 for 2020 in the past 30 days. The company delivered an earnings surprise of 43.99%, on average, in the last four quarters. The stock has surged 97.9% so far this year.

Unum Therapeutics’ loss per share estimates have narrowed from 53 cents to 47 cents for 2020 in the past 30 days. The company delivered an earnings surprise of 36.6%, on average, in the last four quarters. The stock has surged 294.3% so far this year.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Emergent Biosolutions Inc. (EBS) : Free Stock Analysis Report

Horizon Therapeutics Public Limited Company (HZNP) : Free Stock Analysis Report

Unum Therapeutics Inc. (UMRX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research