If Trump isn't re-elected as president, here's what may happen to corporate profits

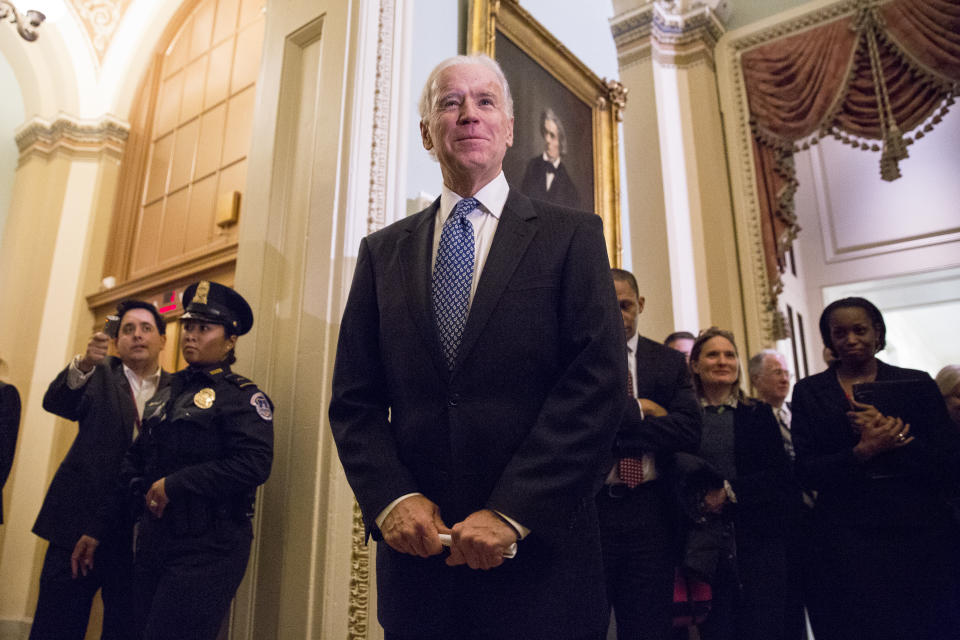

Higher corporate taxes (and personal taxes, too) and lower profits could be lurking in 2021 if former Vice President Joe Biden wins the presidency from President Trump, suggests strategists at Goldman Sachs. The billion-dollar question is whether markets would tank in the lead-up to signs a Biden presidency —and its era of higher taxes on businesses and households — is inevitable.

“For many clients, the most important equity market implication is the potential for higher corporate tax rates,” cautioned Goldman Sachs strategist David Kostin in a new note on Monday.

The Trump tax cuts enacted in 2017 reduced the federal statutory rate for corporations to 21% from 35%. In turn, the effective corporate tax rate fell to 19%. The lower taxes have unleashed higher corporate profits, rising dividends and a fresh wave of stock buybacks. Verdict is still out if corporations have upped capital investments as aggressively as hoped for originally under the tax cut scheme.

The U.S. stock market touched all-time highs in February just before COVID-19 took root in the U.S. — many on the Street would point to the tax cuts as the main driver of surging valuations.

But under the former vice president’s plan, the tax structure is likely to look rather different, Goldman notes. Biden’s tax plan, per data from the Tax Foundation, would lift the federal tax rate on domestic income to 28% from 21%. In addition, it would double the GILTI tax rate on certain foreign income, impose a minimum tax rate of 15%, and add an additional payroll tax on higher earners. Goldman adds that changes to the personal tax code could be made, too, including an increase in the tax rate applied to capital gains and dividends for high-income earners.

Should these tax changes kick in (in the process lifting the corporate tax rate to 26%), Goldman estimates S&P 500 earnings in 2021 would drop 12% to $150 a share from $170 a share. Goldman’s Kostin mentions the new tax law “could also effect corporate earnings and equity valuations.” Kostin stays clear of predicting the magnitude of the impact to equities.

iQ Capital CEO Keith Bliss told Yahoo Finance’s The First Trade he is concerned about the prospect of higher taxes under Biden and how the “manufacturing renaissance” under Trump is kept alive by the former vice president. Ultimately, Bliss said the market is unlikely to start pricing in election risk until midway through the third quarter as debate season begins and Election Day comes more into focus.

Others in the market say higher taxes are a small price to pay right now for a change in leadership inside a White House struggling to deal with a major health pandemic and growing social unrest.

“That is something we’re certainly concerned about [higher taxes]. It has been favorable for our clients tax wise. However the majority, at least here in California, people are willing to take that hit. They realize that for their children, for their grandchildren, for the next generation, I feel like that change is necessary. They feel like that’s something they could do, take that tax hit if Joe Biden gets election,” Sun Group Partners founder Winnie Sun said on The First Trade.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Coca-Cola CEO: here’s what our business looks like right now

Dropbox co-founder: the future of work will be all about this

Levi's reports solid quarterly earnings, CEO says jeans maker will come out of coronavirus stronger

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.