If You Had Bought Adverum Biotechnologies' (NASDAQ:ADVM) Shares A Year Ago You Would Be Down 85%

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it should be a priority to avoid stomach churning catastrophes, wherever possible. So we hope that those who held Adverum Biotechnologies, Inc. (NASDAQ:ADVM) during the last year don't lose the lesson, in addition to the 85% hit to the value of their shares. That'd be a striking reminder about the importance of diversification. We note that it has not been easy for shareholders over three years, either; the share price is down 39% in that time. Shareholders have had an even rougher run lately, with the share price down 66% in the last 90 days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Adverum Biotechnologies

Given that Adverum Biotechnologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Adverum Biotechnologies increased its revenue by 2,900%. That's well above most other pre-profit companies. So the hefty 85% share price crash makes us think the company has somehow offended market participants. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. What is clear is that the market is not judging the company on its revenue growth right now. Of course, markets do over-react so share price drop may be too harsh.

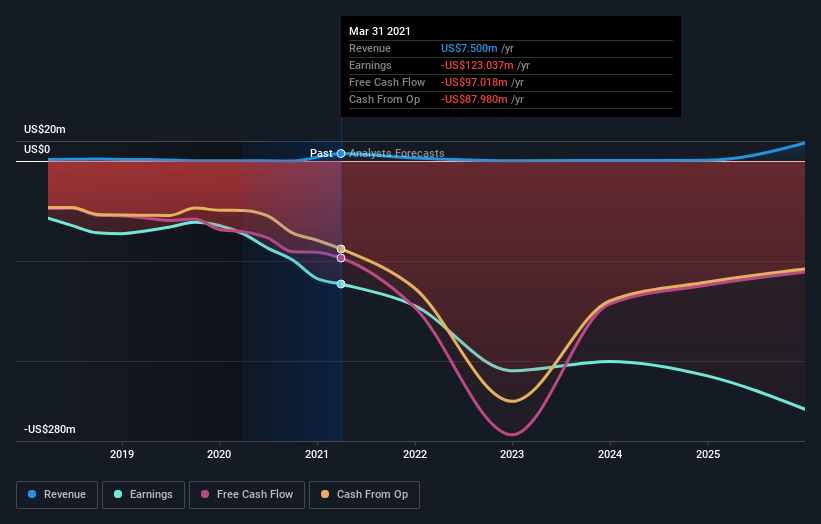

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for Adverum Biotechnologies in this interactive graph of future profit estimates.

A Different Perspective

Investors in Adverum Biotechnologies had a tough year, with a total loss of 85%, against a market gain of about 40%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Adverum Biotechnologies (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

Adverum Biotechnologies is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.