Consumer spending growth at slowest since 2014; stocks cautious ahead of Jackson Hole

Profit warning hit laggards Provident Financial, WPP and Carillion enjoyed a rare rally in London yesterday as investors nervously awaited the Jackson Hole central banking conference.

While analysts have urged investors to tread with caution regarding the recent fallers, the stocks were buoyed by dead cat bounces – the old investor adage that stocks or even a dead cat will bounce if dropped from high enough – with doorstep lender Provident leading the FTSE 100 for a second day.

The doorstep lender regained a further 87p to 748p, although its shares are still down 57pc since Tuesday’s profit warning, scrapped dividend and chief executive departure. Constructor Carillion, another company to dive on a similar triple hit of bad news last month, pushed back up 4.4p to 47p.

The company’s shares – which were trading above 200p in June – plunged to their lowest ever level on Tuesday after it disappointed investors who had been hoping for an update by saying they would have to wait until the end of September for its interim results.

Blue-chip advertising giant WPP meanwhile climbed 42p to £14.62 as the Sir Martin Sorrell-led firm quickly regained ground after Wednesday’s profit warning and worsening sector outlook.

Elsewhere, British American Tobacco’s heavy weighting pulled up the FTSE 100 most, the cigarette maker gaining 111.5p to £48.40 as it made another step into the e-cigarette market by expanding its Glo range throughout Japan.

The FTSE 100’s batch of standout risers helped the index jump 24.41 points to 7,407.06 and outperform its counterparts in Europe as investors awaited key clues on monetary policy in speeches by US Federal Reserve chair Janet Yellen and ECB president Mario Draghi at the Jackson Hole conference.

Fears that Dixons Carphone’s 23pc share price plunge due to second quarter struggles were a canary in the coal mine for the retail sector sent Marks & Spencer and Next sliding 6.2p to 316.4p and 52p to £41.04, respectively, while no-frills airline easyJet retreated 56p to £12.14 on a broker downgrade from Exane BNP Paribas. Dixons ended down 54.5p at 180.8p.

On the FTSE 250, sandwich maker Greencore slipped 18p to 190p despite attempting to reassure investors over its recent share price weakness. The company, which fell 4.7pc on Tuesday and had drifted down 11pc since issuing its most recent trading update in late July, said that it was not aware of any developments that could pull down its share price.

Finally, retailer Game Digital surged a further 4p to 37.3p on Wednesday’s better-than-expected sales growth, bringing its two-day rise to 52pc.

Markets wrap: Investors take their foot off the gas ahead of Jackson Hole conference

Investor caution ahead of key speeches at the Jackson Hole central banking conference tomorrow meant that markets have taken their foot off the gas this afternoon.

The FTSE 100 has outperformed its European blue-chip peers thanks to standout performers with struggling lender Provident Financial's 13pc rebound and WPP's 3pc recovery helping to lift the index.

After coming off this morning's highs, the pound is finishing in flat territory against both the dollar and the euro. Against the greenback, it has slipped back below $1.28 with a mixed bag of data from the ONS this morning doing little to lift it from the eight-year low it hit yesterday against the euro.

The ONS confirmed that the UK economy grew by 0.3pc in the second quarter, a slight pick-up from the previous quarter. While the services sector underpinned the growth, consumer spending growth dipped to 0.1pc, its lowest level since 2014.

IG's chief market analyst Chris Beauchamp gave this review of today's play:

"All asset classes appear to be treading water ahead of Jackson Hole tomorrow, with investors keen to hear what the big-name central bankers will say at the meeting.

"We have seen the FTSE clamber back above 7400, but across the channel eurozone markets remain under pressure. And there has been pressure little direction from the likes of the S&P 500, which remains all but unchanged on the day so far."

FTSE 100 comes off afternoon highs to finish 0.3pc higher

Markets are now closed in Europe and the FTSE 100 has come off its afternoon highs a little late on to record just a 0.3pc rise with a few standout movers doing most of the leg work on the blue-chip index. A round-up of today's events and the market report will follow shortly...

Costcutter close to unveiling a deal as convenience chains rush to consolidate

Costcutter, Britain's second-largest chain of corner shops, has become the latest retailer to be jolted into dealmaking in response to Tesco's £3.7bn swoop on Booker.

Sir Michael Bibby, managing director of Costcutter owner Bibby Line, has revealed in a letter to members that a deal could be announced shortly. It is not known as yet whether Costcutter will be sold, or will be snapping up a rival.

"When Tesco announced its acquisition of Booker back in January, it took the entire market by surprise. Since then, businesses across the grocery and convenience sectors have been open to having discussions that would not have seemed imaginable just one year ago," Sir Michael said in a letter to Costcutter members.

Read Ashley Armstrong's full report here

Traders tread with caution ahead of Jackson Hole

US stock indices have slipped back into the red while European equities' gains have narrowed this afternoon ahead of this week's main event at Jackson Hole in the US.

Traders are treading with caution ahead of the central banking conference tomorrow but European markets won't be open to react to the speeches with US Fed chair Janet Yellen due to speak at 5pm (BST) and ECB president Mario Draghi a little later at 8pm.

CMC Markets analyst David Madden provided this preview of the action in Wyoming:

"The convention for central bankers is the highlight of the week in terms of economic events. All eyes will be on Mario Draghi, the President of the European Central Bank, as his commentary, could shape trader’s outlook.

"The ECB have an aggressive stimulus package in place, but they are running out of bonds to buy, and dealers are wondering what creative way Mr Draghi will come up with to keep the policy loose while snapping up all the government securities that are available to purchase."

Spreadex analyst Connor Campbell said this ahead of Jackson Hole:

"The ECB has already hinted the Draghi won’t use Friday’s speech to signal any major shift in the central bank’s policies. Similar tentativeness is expected from Yellen, though investors will be on the lookout for signs relating to a) when the Fed will start reducing its balance sheet (something that could happen as early as next month, and b) whether there will be another rate hike before the end of 2017."

This afternoon, the FTSE 100 is outperforming all its counterparts thanks to some exceptional rises. Provident has rebounded a further 13pc following Tuesday's huge fall while WPP has recovered 3pc after its 11pc slide yesterday.

UK government will seek to remain 'fully involved' in shaping EU data protection regulations post-Brexit

Britain will seek to remain “fully involved” in shaping EU data protection regulations after Brexit in a hugely ambitious attempt to retain the status quo environment for businesses, the government announced yesterday.

The plan, which was set out in a position paper from the Department for Exiting the EU, was welcomed by tech industry chiefs yesterday, although they quickly warned it would not be easy or straightforward to accomplish.

The question of how both business and government will maintain legal cross-border data exchanges after Brexit remains one of the most pressing of the Brexit talks, with data flows the lifeblood of both trade and security ties.

The 13-page position paper argues that the UK will depart the EU with rules on data-sharing at an “unprecedented point of alignment”, and will seek an early determination from the European side that those flows will be maintained unimpeded immediately after Brexit.

Read Peter Foster's full report here

US markets nudge up with Jackson Hole in view

US stocks have nudged up following the opening bell in New York with traders cautious ahead of the main Jackson Hole conference speeches tomorrow.

Oil giant ExxonMobil is one of a handful of stocks dragging on the index with oil prices slipping today and the company announcing that its output on the Texan coast will be temporarily reduced due to a hurricane approaching the US.

Brent crude has dropped to $52.28 per barrel today despite the US Energy Information Administration yesterday announcing a decline in oil stocks for an eighth consecutive week.

Playtech shrugs off concerns over red tape to post rise in profits

The boss of online gaming and spread betting company Playtech has insisted he welcomes new regulation on the sector, as the company announced an increase in profits.

The gambling industry is facing a predicted rise in regulation around the world that could see more rules and taxes imposed on operators.

But Playtech boss Mor Weizer said that he was confident his company could continue to prosper even though he foresaw a flurry of countries imposing new rules. “There are more than 25 countries which are regulated now and more than 20 are in the process of regulating,” Mr Weizer said.

He added that half of Playtech's sales already came from tougher, regulated markets.

“Importantly, in the process of regulating, not a single country has denied an existing operator from obtaining a licence,” Mr Weizer said.

Read Bradley Gerrard's full report here

Shoppers tighten belts as rising prices dent economy’s growth

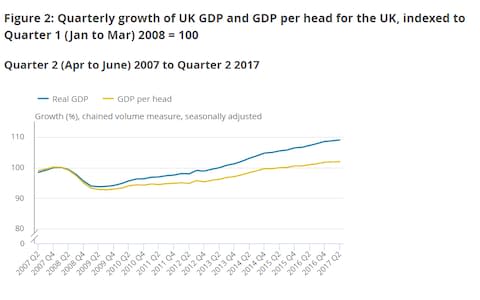

British shoppers are no longer the biggest driver of economic growth as households slowed down their spending spree in the second quarter of the year.

Household expenditure rose by just 0.1pc on the quarter, the weakest performance since late 2014.

That contributed to keeping GDP growth at 0.3pc in the three months to June, the Office for National Statistics (ONS) said.

Compared with the same period a year ago household consumption is still up by 2.8pc, its strongest pace since 2015. But that spurt appears to be grinding to a halt, as rising prices combined with mediocre earningsgrowth eat away at families’ spending power.

Read Tim Wallace's full report here

Stock markets nudge up ahead of Jackson Hole conference

Markets are enjoying a late burst of energy before the Jackson Hole central banking conference kicks off in Wyoming in the US.

Although the conference begins today, the market moving speeches are not scheduled until tomorrow. Mario Draghi's appearance had been earmarked by traders as a possible time for the ECB president to signal a significant change in monetary policy at the central bank.

Reports last week, however, dampened hopes that he would announce the winding down of the ECB's €60bn-a-month quantitative easing programme but traders will still be hanging onto every word.

Rebecca O'Keefe, head of investment at Interactive Investor, explained how investors will be viewing the conference:

"While this gathering is unlikely to result in any major policy decisions, it is still important for investors because of the role of central banks continue to have in market valuations. Global central banks have been instrumental in providing the liquidity which has kept equity markets rising for the past decade. They are also continuing to support investors by being very cautious about any return to ‘normal’ policy.

"The big question for investors is whether conditions are changing, where markets will not be able to rely on central bank policies to support valuations forever. The prospect of less quantitative easing going forward is one hurdle that investors are already having to contemplate."

Stonegate raises Revolution bid as rival weighs counter offer

The battle for control of upmarket cocktail chain Revolution Bars has intensified after pub chain Stonegate raised its offer and rival bidder Deltic said it was weighing a fresh approach.

Stonegate has said its 203p per share offer for Revolution - which values the company at £101m and is up marginally on last month's 200p offer - is now backed by the board. It also has the support of two of Revolution's major shareholders Artemis Investment Management and Castlefield Fund Partners, which own 14.8pc and 4.2pc of the company respectively.

Nightclub owner Deltic had tried to gatecrash the party earlier this month by submitting a counter offer, which would have seen the two companies merge and remain listed.

Shares have jumped 12pc following the news.

Read Bradley Gerrard's full report here

Revolution Bars Group share price

Lunchtime update: GDP growth nudges up to 0.3pc; consumer spending slows to lowest since 2014

The ONS has confirmed this morning that the UK economy picked up slightly in the second quarter of the year, growing at 0.3pc.

It revealed in its more detailed analysis of the UK's second quarter performance that the services sector pushed up growth most from the previous quarter's sluggish 0.2pc figure but added that consumer spending growth had slowed to 0.1pc, its lowest since 2014.

Despite the mixed set of data, the pound has moved off this week's lows against the dollar, trading 0.2pc higher at $1.2821. Against the euro, it has risen 0.3pc to €1.0870 after sliding to an eight-year low yesterday.

Stock markets have rebounded following yesterday's Donald Trump-related fall with the FTSE 100 nudging into positive territory this morning. Provident Financial has continued to recover ground from its huge 66pc slide on Tuesday while easyJet has fallen 3.5pc following a broker downgrade from Exane BNP Paribas.

Meanwhile on the mid-cap FTSE 250 index, Dixons Carphone has nosedived 23pc after issuing a profit warning. The PC World and Currys owner put the blame on consumers holding onto their phones for longer and said that the change to EU roaming rules will bump up costs.

Here's Accendo Markets' head of research Henry Croft's analysis of this morning's action:

"Equity markets are positive across the board this morning, with the FTSE 100 outperforming thanks to a double breakout from resistance shortly after the open, helped by a mix of technical breakouts and corporate results, alongside a couple of post-profits warnings recovery rallies (or potential dead cat bounces?).

"Despite Sterling rallying from overnight multi-month lows, this has done little to dampen sentiment."

Retail sales fell at fastest pace since July 2016, says CBI

Retail sales volumes fell in the year to August, disappointing expectations for further growth. #CBI_DTShttps://t.co/2b5IGVNZBHpic.twitter.com/wQ1oTPnKPO

— CBI Economics (@CBI_Economics) August 24, 2017

More woe for the British consumer and retailers has just dropped from the Confederation of British Industry.

Retail sales volumes fell in August at their fastest pace since July 2016, according to the CBI's latest survey.

The data showed that 34pc of retailers said volumes were up in August compared to a year ago, compared with 44pc that said they had dropped. The -10pc balance was far below expectations of +14pc and July's +22pc figure.

The CBI said, however, that grocers and footwear and leather stores experienced solid growth and that retailers expect sales volumes to rebound in September.

Its head of economic intelligence Anna Leach said on the data:

"Despite the warmer weather at the start of the month, retail sales have cooled as higher inflation continues to squeeze consumers’ pockets. Meanwhile, deteriorating sentiment regarding the business situation has combined with falling headcount among retailers.

"Looking ahead, firms do expect sales growth to recover, but the pressures on household budgets are set to persist, given little sign of wages picking up."

GDP growth reaction: Drop in car sales could partly explain consumer spending drop

Capital Economics' UK economist Paul Hollingsworth has pointed out that the fall in spending on cars following the introduction of the Vehicle Excise Duty in April could explain some of today's fall.

Car sales spiked just before the new tax was introduced and have experienced several consecutive months of decline since.

Mr Hollingsworth explained:

"While Q2’s breakdown was fairly disappointing, it is worth noting that the slowdown in household spending growth was partly driven by a fall in spending on cars, which probably reflected shifting purchases to beat the change in Vehicle Excise Duty earlier this year. Growth in car spending is therefore unlikely to take another sharp leg down.

"What’s more, survey measures of firms’ investment intentions suggest that Q2’s slowdown in business investment will prove short-lived. And firms’ export orders continue to point to a strengthening in export growth, while the slowdown in consumer spending growth should curtail growth in imports."

Premier Oil raises production guidance after record start to the year

Premier Oil has raised its full-year production guidance after production in the first half of the year jumped 35pc to record levels.

The oil and gas explorer also said it expects to produce more than previously thought on its Catcher project in the North Sea, which is producing first oil later this year.

Premier expects the project to produce 60,000 barrels of oil equivalent per day, 20pc higher than previous estimates, after test flow rates were “above original prognosis”.

Full-year production guidance, meanwhile, has been raised to between 75,000 and 80,000 barrels of oil equivalent per day, up from 75,000.

Read Sam Dean's full report here

Dixons Carphone will be hoping the new iPhone is a hit

Dixons Carphone has pared some its huge early losses and is now 25pc down following its profit warning this morning. Although the company highlighted the "challenging" UK mobile phone sector, investors are taking it as a company-specific issue with Vodafone dipping just 0.1pc on the FTSE 100.

After today's fall, Dixons-Carphone shares have lost a staggering 65% of their value since the start of 2015. #WhenMarketsMature

— Garry White (@GarryWhite) August 24, 2017

Henry Croft, research analyst at Accendo Markets, believes that the lack of innovation at the tech giants has weighed on consumer demand.

He commented:

"The lack of innovation from companies such as Apple and Samsung (with their top-of-the-market iPhone and Galaxy models) has dented the need for consumers to purchase the latest offering from producers, exacerbated by the fact that growing homogeneity between rival products means that they are indistinguishable from each other in a day to day capacity.

"With no significant upgrade needed in order to access amenities such as 4G, and software updates freely available to older models, consumers are holding onto their phones for longer; especially given that FX fluctuations have made the relative price of handsets considerably more expensive for UK consumers."

Could that be about to change if Apple releases its hotly anticipated new iPhone next month?

Nicholas Hyett, equity analyst at Hargreaves Lansdown, also pointed to a lack of new technology in the sector to wow consumers as a factor.

He added that currency has also been an issue:

"While the honeybee and receivable revaluation are one-off, non-cash or both, news that UK consumers are hanging on to their phone’s for longer is more concerning.

"Currency movements will have made new phones more expensive, but since the same should be true in the electronics business, which is faring well, we suspect the lack of significant innovation in recent models is a bigger problem."

UK GDP growth snap reaction: UK consumer spending hits lowest since 2014

Q2 GDP growth left unrevised at 0.3%, but both household spending and business investment were broadly flat on the quarter pic.twitter.com/iKRB4Kva45

— CBI Economics (@CBI_Economics) August 24, 2017

Consumer spending growth slowed to 0.1pc in the second quarter, according to the ONS, a two-and-a-half-year low. Consumer spending fell to far below last year's figures when growth bobbed around 0.7pc-0.8pc.

With economists expecting inflation to pick-up to 3pc before the end of the year and wage growth to continue to hover around 2pc, will these figures worsen?

ING's developed markets economist James Smith said this on the consumer spending figures:

"This result is particularly worrying, given retail sales data suggested the combination of a late Easter and the second warmest June on record had given retailers temporary respite from the household income squeeze.

"But today's data supports the findings of other data providers - notably Visa and the British Retail Consortium - who have suggested that recent months have been particularly slow for spending as consumers cut back on non-essentials. Of course, today's GDP data is fairly backwards-looking - so the question now is whether the squeeze on household incomes has peaked as the Deputy Bank of England Governor Broadbent suggested recently."

Jasper Lawler, head of research at London Capital Group, said this on how the figures affect interest rates and the pound:

"While UK growth trudges along at a slow pace, the Bank of England will view it as offset by above-target inflation. The decision whether to raise rates is still finely balanced and we expect the Bank of England to continue to do what they know best, nothing.

"The worrisome domestic picture adds to outside factors that could play against the pound like Fed policy normalisation and tapering by the ECB. The next clues with this regard may come from speeches by Federal Reserve Chair Janet Yellen and ECB President Mario Draghi at Jackson Hole on Friday."

Although it dipped following the release, the pound has rebounded back into positive territory against the dollar. It's now 0.2pc up for the session against the greenback, trading at $1.2820.

UK GDP growth sluggish compared to developed rivals

Disappointing Q2 GDP breakdown. But HH slowdown partly driven by VED changes & surveys suggest a pick-up in bus inv.& export growth in store pic.twitter.com/lzj5GVQoHv

— Capital Economics (@CapEconUK) August 24, 2017

Today's release is painting a mixed picture of the UK economy with two of the four sectors the ONS has divided the UK into showing growth and other two contracting.

Services and agriculture grew by 0.5pc and 0.4pc, respectively, while production and construction declined 0.3pc and 1.3pc, respectively. The ONS said that the large fall in construction was driven mainly by drops in new work and repair and maintenance figures.

How's our growth holding up against other developed nations?

Not great, truth be told. Our second quarter growth is half of Germany, the overall eurozone and the US' 0.6pc growth.

UK GDP snap reaction: Flat business investment to be expected ahead of Brexit negotiations

GDP for Q2 unrevised at 0.3%, but slow down in car sales, business investment & consumer spending. Some signs of a slowing economy? #UK#GDPpic.twitter.com/ES7bUGmD1U

— @Statsman (@DossaAnand) August 24, 2017

Here's some the snap reaction to the news that the ONS has confirmed that the UK economy grew by 0.3pc in the second quarer, a slight pick-up from the first quarter.

Research director at City Index Kathleen Brooks commented that disappointing export figures could be a concern for investors:

"The highlights were stronger than expected investment data and stronger services. Government spending was stronger than expected at 0.6% on the quarter compared to 0.3% expected. Another disappointment was exports, it missed the 1% expected, and exports only expanded by 0.7% last quarter. This is likely to leave investors concerned that the UK export sector may never be able to benefit from nothing to GDP last quarter.

"Business investment was flat, however capital investment was stronger than expected. One would expect business to be cautious ahead of the Brexit negotiations, however, the fact that capital investment (ie, building things) is stronger than expected is good news, and suggests that some investors are willing to look through Brexit to our future outside of the EU."

Traders on the currency markets were disappointed by private consumption figures, according to London Capital Group analyst Ipek Ozkardeskaya. She said:

"The pound edged lower after the second quarter GDP estimate showed that the private consumption eased to the weakest level since 2014. The government spending and capital formation were better-than-expected and compensated for the slower household spending.

"Exports rose less-than-expected despite the soft pound, imports retreated from 1.7% to 0.7% on the quarter. The final figure matched the expectation of 0.3% quarter-on-quarter GDP growth, yet the composition displeased."

UK GDP growth key takeaways

UK GDP growth in the second quarter of the year has been confirmed at 0.3pc, a slight pick-up from 0.2pc in the first quarter.

Growth was driven by the services sector, which experienced 0.5pc quarter-on-quarter growth.

The ONS said that, while government spending and investment remained strong, there was a slowdown in growth in both household spending and business investment.

The pound has retreated slightly following the figures and is now in flat territory against the dollar.

UK economy grew at 0.3pc in the second quarter

UK GDP growth nudged up to 0.3pc in the second quarter of the year, the ONS has just confirmed.

The pick-up from 0.2pc growth in the first quarter had been shown in the preliminary reading and therefore has caused little fanfare on the currency markets.

GDP figures due soon; second estimate expected to remain unchanged at 0.3pc

The second estimate of UK second quarter GDP figures is due at the bottom of the hour and we're expecting growth to come in unchanged at 0.3pc.

If so, the currency markets will barely flinch but a surprise revision should stoke a bit of movement in the pound which has had a poor week, dropping yesterday to a fresh eight-year low against the euro.

CMC Markets analyst Michael Hewson points out that there has been a large discrepancy between independent industry surveys and official growth figures. Official figures from the Office for National Statistics have shown the economy to be a little sluggish this year but the surveys paint a brighter picture.

Mr Hewson added this on the discrepancy between figures:

"For all of this year these independent surveys have been much more optimistic, from the likes of the CBI and the Markit, and quite frankly better when it comes to reporting the improvement in order books in terms of surging export markets, as well as rising employment levels in the sector.

"The ONS numbers on the other hand have been uniformly negative with only one positive month so far this year, in April which rather invites the question as whether the ONS numbers are even fit for purpose, which then goes on to raise the question as to whether the GDP numbers are fit for purpose either."

Dixons fall 'stokes fresh retail fears'; easyJet falls hardest on FTSE 100

Are Dixons Carphone's difficulties a canary in the coal mine for the UK retail sector?

Here's ETX senior market analyst Neil Wilson's take on what this morning's huge fall means for the sector:

"Dixons Carphone stoked fresh fears about the health of the UK retail sector with a profits warning amid a tough mobile phone market and lower earnings from its software division. After the Provident Financial collapse, another profits warning is probably the last thing the City needs right now.

"In the core retail area, the UK mobile phone market is proving a tough nut in 2017. Consumers are holding onto phones for longer. Brexit matters here – the weak pound exchange rate has made devices more expensive and consumers are less willing to replace old handsets so quickly."

Tues: Provident Financial drops 66%

Weds: WPP drops 10%

Thurs: Dixons Carphone drops 30%

Carnage across different sectors. Crazy— Simon Neville (@SimonNeville) August 24, 2017

On the FTSE 100, easyJet is the sharpest falling, dropping 2.7pc early on, after Exane BNP Paribas downgraded the no-frills airliner to "underperform" while at the other end Provident Financial has continued to rebound following Tuesday's incredible share price plunge.

Its shares dropped 66pc on Tuesday after it forecast a full-year loss, scrapped its dividend and its chief executive left. Yesterday it recovered 12pc and this morning it has risen a further 13pc.

Dixons Carphone plunges 30pc; 'challenging' UK mobile phone market blamed

The profit warning from Dixons Carphone (driven by the mobile phone business...) will go down like a lead balloon in the City today... https://t.co/olMI2rrMMa

— Nick Bubb (@NickBubb1) August 24, 2017

UK investors not pulling any punches after profit warnings

Tuesday: Provident -66%

Yesterday: WPP - 13%

Today: Dixons Carphone -25%— Jasper Lawler (@jasperlawler) August 24, 2017

PC World and Currys owner Dixons Carphone is being ruthlessly punished on the FTSE 250 following this morning's profit warning.

Shares have plunged 30pc after it said in an unscheduled trading update that profit would now be between £360m and £440m compared to £501m last year as customers are holding onto their phones for longer.

The company said that the UK mobile phone market was "challenging" with this being the week's third huge fall in London after Provident Financial and WPP tanked 66pc and 11pc, respectively, on their updates to the market.

Sam Dean has all the details on Dixons' plunge here

Another extreme market reaction to some weak trading numbers... Dixons Carphone shares plunge 30% to 160p

— Alex Sebastian (@MrAlexSebastian) August 24, 2017

Agenda: Dixons Carphone plummets 30pc; pound stuck below $1.28 ahead of UK GDP data

UK GDP data is the focal point for traders this morning with the pound still stuck near the lows it hit yesterday against the dollar and euro ahead of the release.

The preliminary reading released last month showed that the UK economy picked up slightly in the second quarter, growing at a rate of 0.3pc. While the figure was an improvement on the sluggish 0.2pc figure from the first quarter, UK growth is still underperforming Europe and the US and economists expect today's reading to remain unchanged from the first estimate.

Ahead of the the fresh figures, the pound has nudged up from its eight-year low against the euro to €1.0850 while against the dollar it's in flat territory, trading just below $1.28.

Donald Trump's threat to end the North American Free Trade Agreement and shutdown the government to secure funding for his wall on the Mexican border pulled equities back down from Tuesday's highs yesterday and today European stocks have rebounded back into the green.

Today's standout mover in London is retailer Dixons Carphone which has plunged 30pc after issuing a profit warning. The retailer said that customers were holding onto their phones longer than expected and that full-year profit estimates had been revised.

Interim results: Macfarlane Group, Hunting, Polymetal International, PV Crystalox Solar, Premier Oil, Playtech

AGM: Puma VCT 8, Nextenergy Solar Fund, Triple Point Income VCT, City of London Group, Servision

Economics: Second estimate GDP q/q (UK), Index of services 3m/3m (UK), Preliminary business investment q/q (UK), CBI realised sales (UK), Unemployment claims (US), Existing home sales (US)