Is Bitcoin Washed Up – or Is the Tide About to Turn?

Sadly, it wasn’t to be. Since the beginning of the year, an incredible $550 billion has been lost in the cryptocurrency markets. Those who bought near the top are nursing losses of around 70%, on average.

It is little wonder those investors who are not so seasoned in the reading of the markets, and the “cycle of investment,” are running scared – or just standing on the sidelines, with their mouths open, watching the avalanche roll down the hill.

It’s a prescient time to remind ourselves where we are now – and put these losses in perspective.

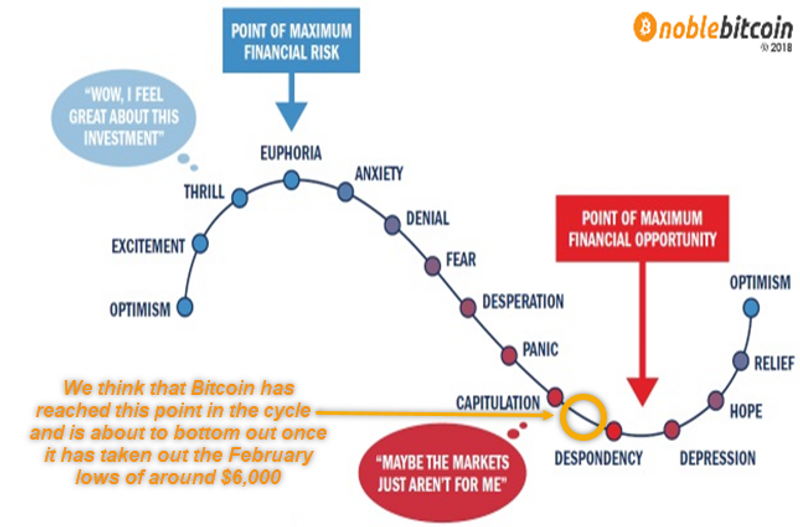

This graph shows a typical cycle of investor sentiment. We show this graph to our clients all the time. If you apply it to the excitement and optimism of last Autumn, as Bitcoin started to become popular, you can almost see it follow the pattern of the Bitcoin price chart. As the thrill and euphoria of being on board turned to worry and concern, those investors who had not taken into account the fact that they could lose money, as well as make it, had a major problem – they had no plan B – or C.

This was fine for those who could afford to lose the money – but stories abound, of folk who remortgaged homes, and sold solid assets, to get a piece of the action – without thinking through the consequences of any loss-making situation.

Our feeling is, that we have reached the “despondency and depression” point on the graph (see the golden circle). Those investors who have lost large amounts of money have given up on Bitcoin completely – many simply setting the loss aside, and writing it off as a bad experience.

But – look at the next part of the chart – once the price picks up, hope turns to relief, which turns to optimism – and the whole cycle starts again.

With this in mind – a look at the daily chart, for this year, brings a new perspective into play:

Although Bitcoin is only one of over a thousand cryptocurrencies, it is, undoubtedly, the one which has the most impact – for good or bad – across the board.

The relentless fall since December of last year (which can be viewed as the point of maximum financial risk, on the cycle of investor sentiment chart above), at 1) broken, only, by the rally during February, at 2) continuing through,m 3) – which is where we find ourselves today – has been the precursor to multiple falls across the cryptocurrency complex.

Noble Gold specializes in IRAs and 401(k) rollovers through precious metals and cryptocurrencies investments.

This article was originally posted on FX Empire