Best Buy: Coca-Cola, McDonald's, or Verizon?

Coca-Cola (NYSE: KO), McDonald's (NYSE: MCD), and Verizon (NYSE: VZ) each reported lower revenue through the first nine months of 2017. Yet investors have had dramatically different responses to recent operating trends for these companies. McDonald's stock is outpacing the broader market's by a wide margin, Coke is underperforming, and Verizon is deep in negative territory with a 15% loss.

Below, we'll stack these Dow giants against each other to see which might make the better buy for investors today.

Stock comparison

Metric | Coca-Cola | McDonald's | Verizon |

|---|---|---|---|

Market capitalization | $195 billion | $135 billion | $185 billion |

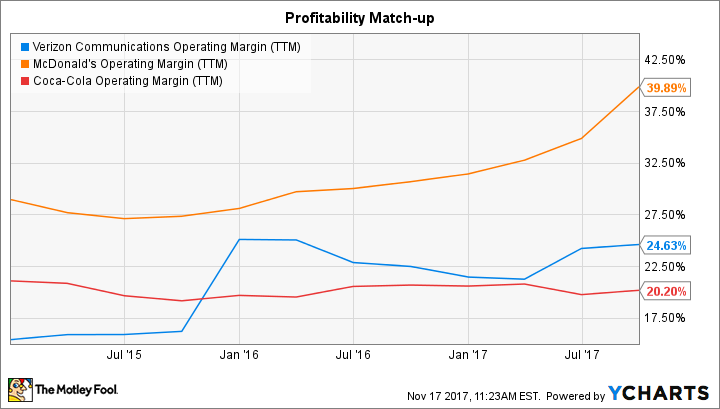

Operating profit margin | 20% | 40% | 25% |

Dividend yield | 3.2% | 2.4% | 5.2% |

Performance year to date | 10% | 37% | (15%) |

Profit margin is for the trailing 12 months. Stock performance is through Nov. 17. Data sources: Company financial filings, YCharts.

The momentum matchup

McDonald's is the clear winner in this matchup when it comes to operating momentum. The fast-food giant's customer traffic trends are improving across each of its geographies today, including in the critical U.S. segment. This rebound allowed Mickey D's to post a 6% spike in comparable-store sales in late October to mark just a slight slowdown from the prior quarter's 6.6% jump.

Image source: Getty Images.

Coke's results look tame in comparison. The beverage titan's sales volume is flat so far this year after having risen by 1% last year and by 2% in 2015.

Verizon brings up third place on this metric, as its wireless revenue is down 3%. The communications giant has managed a slight uptick in its customer base, but that improvement is being overwhelmed by lower average monthly payments.

Finances and cash returns

The same general story applies to profit growth. Sure, Coca-Cola is set to raise its operating margin through a refranchising initiative that's spinning bottlers out of its business. And Verizon has aggressive cost-cutting plans that should see it remove $10 billion from its expense burden over the next four years.

Yet McDonald's has the brightest outlook for improving profitability -- and that was true even before its recent uptick in sales growth. The fast-food titan is busy reducing its share of company-owned locations to just 5% from the 15% it controlled at the end of 2016. That refranchising strategy is lowering reported earnings. In fact, sales are down 6% so far this year. But in exchange, CEO Steve Easterbrook and his team get a higher proportion of those steady, repeatable, and highly profitable franchise fees. The shift has already produced a spike in operating margin up to 38% of sales from 33% a year ago. Management is targeting further gains on this metric with profitability reaching the mid-40s by late 2019.

VZ Operating Margin (TTM). Data by YCharts.

Why buy McDonald's

The fact that these companies operate in different industries limits the usefulness of direct comparisons between their valuations. Still, it's fair to say that Verizon is the cheapest of the bunch. Its price-to-earnings ratio is less than half the 25 times an investor would have to pay to buy either Coca Cola or McDonald's today. Verizon is also valued well below the broader market average.

Investors seeking a conservative stock purchase -- with an unusually high yield -- might consider Verizon a solid bet. Just keep in mind that this dividend has only grown for 11 consecutive years, compared to 56 for Coke and 42 for McDonald's.

In my view, the fast-food giant makes the best all-around purchase today, though, due to its healthy operating trends and improving profitability. Sure, Mickey D's 2.4% yield is the lowest of the group. Yet that payout should grow quickly since it is the main avenue by which management is planning to send $23 billion to shareholders in the next few years.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Demitrios Kalogeropoulos owns shares of McDonald's. The Motley Fool owns shares of and recommends Verizon Communications. The Motley Fool has a disclosure policy.