Ball Corp (BALL) Q2 Earnings Miss, Sales Beat Estimates

Ball Corporation BALL reported second-quarter 2022 adjusted earnings of 82 cents per share, missing the Zacks Consensus Estimate of 98 cents. The bottom line declined 5% year over year. This compares to our estimate of 89 cents for the quarter.

On a reported basis, the company reported a loss per share of 55 cents against the prior-year quarter’s earnings per share of 61 cents. BALL recorded non-cash, long-lived asset impairment for Russian operations during the quarter.

Total sales were $4,134 million in the reported quarter, up 19.5% from the year-ago quarter’s levels and surpassed the Zacks Consensus Estimate of $3,929 million. Our estimate for the quarter was $$3,949 million. Global beverage can shipments were up 3.3%.

Operational Update

Cost of sales amounted to $3,445 million in second-quarter 2022, up 25% from the year-ago quarter’s levels. The gross profit totaled $689 million, down from the year-ago quarter’s $699 million. The gross margin came in at 16.7%, down from the prior-year quarter’s 20.2%.

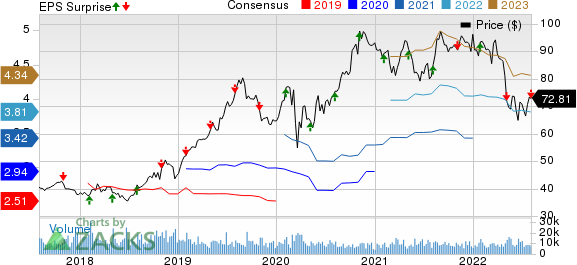

Ball Corporation Price, Consensus and EPS Surprise

Ball Corporation price-consensus-eps-surprise-chart | Ball Corporation Quote

Selling, general and administrative expenses decreased 3% year over year to $161 million. Adjusted operating profit was $392 million compared with the prior-year quarter’s $399 million. Adjusted operating margin came in at 9.5%, a 200 basis point contraction from the prior-year quarter.

Segment Performance

The Beverage packaging North and Central America segment revenues increased 16.5% year over year to $1,775 million in the second quarter. Operating earnings amounted to $164 million, down 15% year over year.

Sales at the Beverage packaging, EMEA segment were $1,133 million in the quarter, up 25% year over year. Operating earnings were $129 million, up 4% year over year.

The Beverage packaging South America segment’s revenues were $534 million in the reported quarter, up 18% year over year. Operating earnings slumped 33% to $52 million.

The Aerospace segment’s sales were up 7% year over year to $490 million. Operating earnings increased 6% to $363 million. At the end of the quarter, the segment’s contracted backlog was $3 billion. Contracts already won but not yet booked into the current contracted backlog were $4.7 billion.

Financial Condition

The company reported cash and cash equivalents of $480 million at the end of second-quarter 2022, down from $571 million at the end of the prior-year quarter. Cash utilized in operating activities amounted to $398 million in the first half of 2022 compared with an inflow of $168 million in the comparable period last year.

Ball Corp plans to return approximately $1 billion to shareholders through dividends and share repurchases. It has initiated actions to rephase certain beverage can growth capital projects and optimize production capabilities to meet market growth.

The company’s long-term debt increased to $8.85 billion at the end of the second quarter from $6.97 billion at the end of the year-ago quarter.

Price Performance

Image Source: Zacks Investment Research

The company’s shares have lost 7.9% over the past year compared with the industry’s decline of 3.9%.

Zacks Rank and Key Picks

Ball Corp currently carries a Zacks #3 Rank (Hold).

Some better-ranked stocks from the Industrial Products sector are Greif Inc. GEF, Titan International TWI and MRC Global MRC. All of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Greif has an estimated earnings growth rate of 37% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 17%.

Greif pulled off a trailing four-quarter earnings surprise of 22.9%, on average. GEF’s shares have risen 15% in the past year.

Titan International has an estimated earnings growth rate of 165% for the current year. In the past 60 days, the Zacks Consensus Estimate for current-year earnings has been revised upward by 43%.

Titan International pulled off a trailing four-quarter earnings surprise of 56.4%, on average. TWI’s shares have soared 83% in a year.

MRC Global has an expected earnings growth rate of 259% for 2022. The Zacks Consensus Estimate for the current year’s earnings has moved up 24% in the past 60 days.

MRC Global has a trailing four-quarter earnings surprise of 140.8%, on average. MRC’s shares have surged 41% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Titan International, Inc. (TWI) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

MRC Global Inc. (MRC) : Free Stock Analysis Report

Ball Corporation (BALL) : Free Stock Analysis Report

To read this article on Zacks.com click here.