NBA Minority Stake Sales May Expand as Arctos Seeks to Join Dyal as Approved Investor

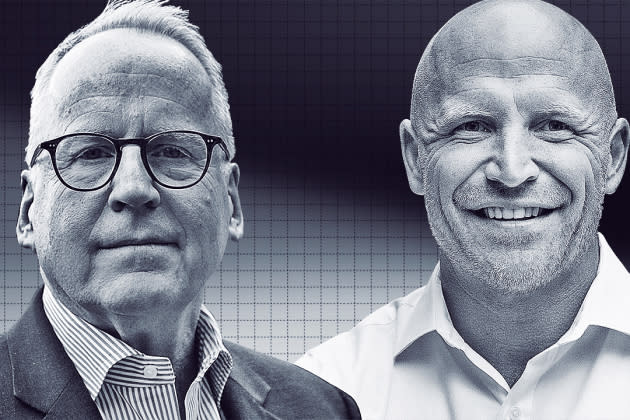

Arctos Sports Partners, a private equity firm co-led by former Madison Square Garden CEO Doc O’Connor, is seeking permission to build a portfolio of minority stakes in NBA teams, according to people familiar with the matter. Madison Square Garden is the parent company of the New York Knicks.

Arctos is looking to become just the second institutional investor granted permission by the league to make those investments, the people said. The people were granted anonymity because the matter is private. Earlier this year, the NBA approved Dyal Capital Partners, a unit of Neuberger Berman, as its first partner in the endeavor.

Representatives for Arctos and the NBA didn’t immediately return requests for comment.

Should Arctos be approved, it will likely require some negotiation with the league. Under Dyal’s deal from last spring, the NBA agreed to provide some services, and will receive both an undisclosed share of management fees and a cut of profits, according to a recent prospectus.

Dyal announced last month that it was combining with another asset manager and going public through a special purpose acquisition company (SPAC). A prospectus filed earlier this week says Dyal is yet to close any money for its NBA fund, called HomeCourt, and that it is “subject to ongoing negotiations with the NBA.” A spokesman for Neuberger Berman didn’t immediately respond to requests for clarification on those talks.

The NBA began exploring this option in late 2019 and early 2020, prior to the full onset of the pandemic. It is the league’s response to a growing problem for most major sports leagues—as franchise valuations soar into the multiple-billions, the number of people with both the interest and wealth to purchase minority stakes is shrinking. In the last few years, a number of minority owners put their NBA stakes up for sale, only to pull them back because they didn’t draw the interest they expected.

All that happened before the COVID-19 pandemic, which has disrupted both the 2019-20 and 2020-21 NBA seasons. Revenue has declined on the order of tens of millions per team, and owners are looking for capital, a process that could involve selling portions of their teams, or making capital calls on existing LPs.

In the NBA, the Minnesota Timberwolves are for sale, while a handful of other teams, including the San Antonio Spurs, are looking for investments. Allowing private equity investors to buy up multiple minority stakes, and expanding the number of firms with the go-ahead to do so, could make it easier for teams to access money at an important time.

Arctos, which launched earlier this year, is led by O’Connor and private equity veteran Ian Charles. It is one of a new class of private equity investors looking to acquire minority stakes in teams across the globe. In November the company reached $950 million in assets under management. Arctos has partnered with Sportico to present a live event on fan experience later this month.

(For more information about the soaring growth of NBA team valuations, and the impact of the pandemic, Sportico is unveiling its first NBA valuations in a free virtual event on Jan. 19. Sign up here.)

More from Sportico.com