3 Big Stock Charts for Thursday: Chevron Corporation, Kinder Morgan Inc and Oneok, Inc.

The energy sector is turning white hot as crude oil is starting to show signs that the commodity has found some parity and room to room to run higher over $53 in more than a year. The rally in crude oil is helping a number of companies in the sector, but there are still a number of well-known names within the group that investors should avoid or even think of shorting.

Today’s three big stock charts identify Chevron Corporation (NYSE:CVX), Kinder Morgan Inc (NYSE:KMI) and Oneok, Inc. (NYSE:OKE) as three companies that are going to lag the sector while offering opportunities for traders looking for stocks to short in the group.

Chevron Corporation (CVX)

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

One of the larger names in the energy sector, CVX has had a rough time trying to right their ship as investors continue to spend time worrying over the company’s fundamental outlook. Despite an upbeat earnings report, traders are taking the opportunity to sell into any strength lately.

Because of this, the stock remains a sell according to our models.

Chevron shares are tracking to break below their 50-day moving average, which has been strong support over the last three weeks. Volume is increasing on this break suggesting that the technical traders are starting to take action on the potential breakdown.

Stock chart support rests resides at $116 right now on CVX shares. A break below this and the $115 level will increase selling pressure as these prices represent large quantities of put open interest. This means that the options market will have to start hedging by selling as these prices break.

The Chande Trend Meter is turning bearish on CVX shares, indicating that momentum is starting to build on the selling side of the market. For now, this identifies $108 as a target price for CVX shares before year-end.

Kinder Morgan Inc (KMI)

Kinder Morgan gave the market a good earnings report based on lowered expenses, but the fundamentals remain tepid for the pipeline company. Just after earnings, we saw a few of the larger brokers drop their target prices on KMI shares. The move shouldn’t have been a surprise as the company’s revenue shrunk by 1.5% year-over-year. The technicals remain bearish for KMI at this time as a result.

Kinder Morgan shares are trading deep in bear trend territory as the stock is well below its 20-month moving average. In addition, the 20-month is trending lower itself, adding to the long-term bearish selling pressure.

The recent break below $18 takes KMI shares below a critical chart support level that has been able to bolster the shares through 2017. A monthly close below this will send KMI shares lower through the year-end.

In addition to the break below $18, the stock’s 10-month moving average is now moving below the 20-month, strengthening the bear market trend. At this time, our models suggest a price of $14.

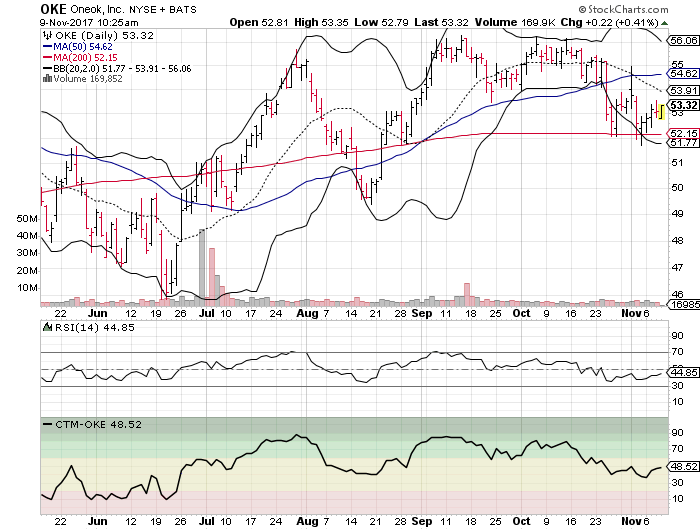

Oneok, Inc. (OKE)

Operating in the natural gas area, Oneok has been left behind in the energy rally as shares are actually transitioning into a neutral to bearish outlook based on the technicals.

This indicates that the next four to six weeks are likely to see pressure from sellers and an opportunity to potentially profit from shorting the stock.

OKE missed its earnings numbers on Oct. 31 resulting in selling pressure that formed a top at $55. This is the second in a series of lower highs for the stock — a bearish pattern.

The post-earnings price activity saw a very fast attempt to break through the stock’s 50-day moving average, which is in the process of transitioning into a neutral pattern. This indicates that the trading community is looking to sell into any strength.

OKE’s 200-day moving average is sitting just below current prices at $52.15 and it acted as support last week. A break through this trendline is going to trigger another selling spree that will target $49 according to our model.

As of this writing, Johnson Research Group did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post 3 Big Stock Charts for Thursday: Chevron Corporation, Kinder Morgan Inc and Oneok, Inc. appeared first on InvestorPlace.