How Privatizing Fannie Mae and Freddie Mac Could Affect Home Buyers

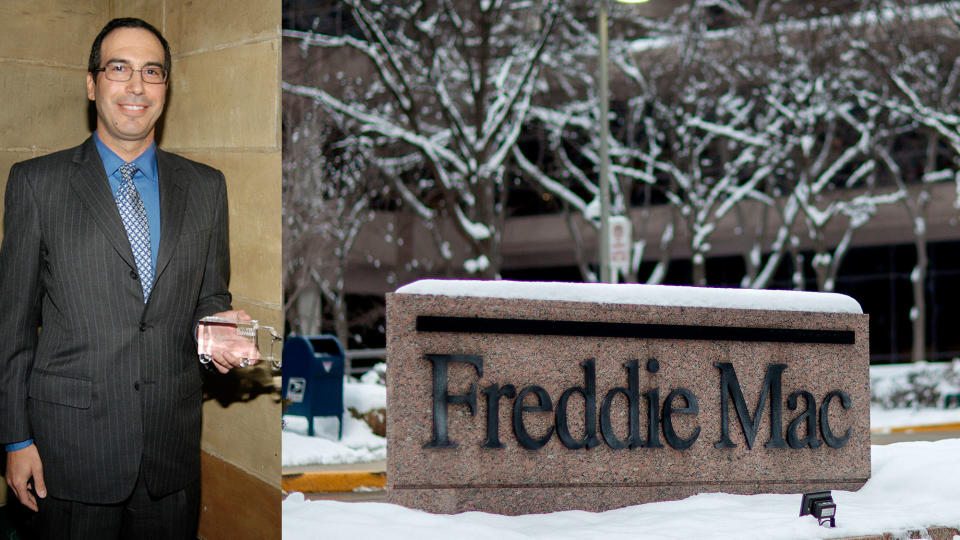

Patrick McMullan via Getty Images; Andrew Harrer/Bloomberg via Getty Images

The new Republican administration doesn’t take control until late January, but key officials are already making moves to shake up the housing market—starting with privatizing Fannie Mae and Freddie Mac.

Steven Mnuchin, whom President-elect Donald Trump picked to be the new secretary of the U.S. Department of the Treasury, told Fox Business that the Federal National Mortgage Association (aka Fannie Mae) and Federal Home Loan Mortgage Corp. (aka Freddie Mac)—the two enormous, government-sponsored enterprises that play key roles in America’s home mortgage market—will be restructured and privatized.

So what will happen when these two organizations are freed from government control? Details on what a restructuring could entail and, more importantly, what that would mean for home buyers are slim.

“The implications to the housing market could be large given the role that [Fannie and Freddie] play in the mortgage market,” said Jonathan Smoke, chief economist of realtor.com®. However, “assessing the impact would require details on what’s being planned.”

Mnuchin’s rationale for prioritizing the privatization of Fannie and Freddie is his contention that they displace private mortgage lending

“So let me be clear: We’ll make sure that when they’re restructured, they’ll be safer and they don’t get taken over again but we’ve got to get them out of government control,” said Mnuchin, a former Goldman Sachs executive, on Wednesday. “And we’ll get it done reasonably fast.”

Fannie and Freddie don’t actually hand out mortgages to would-be homeowners. Instead they buy the loans from mortgage makers, combine them into securities, and then guarantee them to investors in the case that a buyer defaults on monthly payments. Because they’re essentially insuring the loans, lenders can give out the relatively inexpensive 30-year fixed-rate mortgages that are popular today.

On the plus side, private companies could just as easily back the mortgages, says Don Frommeyer, CEO of the National Association of Mortgage Brokers. And he doesn’t foresee a big jump in mortgage rates.

Not everyone is sanguine about the impact of such a change.

“Without these agencies to support first-time home buyers, buyers have [few] other solutions, because the private market doesn’t have the lending capacity, the rates will not be as low, and it could be harder for borrowers to qualify for loans,” Peter Orser, acting director of the Runstad Center for Real Estate Studies at the University of Washington, previously told realtor.com.

Privatizing Fannie and Freddie has the potential to raise the debt-to-income ratio, which is how much debt a buyer can carry when seeking a mortgage, says Frommeyer. That could conceivably make it harder for someone with student, medical, or credit card debt to get a loan.

“It could be a big deal,” Frommeyer says.

Mnuchin isn’t the first Republican to want to remove Fannie and Freddie from government control.

Rep. Jeb Hensarling of Texas, the Republican chair of the House Financial Services Committee, proposed phasing them out over five years, according to Bloomberg. Meanwhile, Republican Sen. Robert Corker of Tennessee co-sponsored a bill to get rid of Fannie and Freddie altogether.

Fannie and Freddie have not always been under government control. They were bailed out after the housing bubble burst by the U.S. government in 2008—a financial rescue that wound up costing taxpayers a whopping $187.5 billion over time, according to Bloomberg. They’ve since filled the U.S. Treasury’s coffers with more than $250 billion.

The fact that they’re such cash cows for the Treasury leads Frommeyer to doubt that they’ll ever be fully privatized.

“Right now, there’s just too much money going to the government,” he says.

The post How Privatizing Fannie Mae and Freddie Mac Could Affect Home Buyers appeared first on Real Estate News and Advice - realtor.com.