Buffett Stocks in Focus: General Motors

- By Ben Reynolds

(Published Feb. 28 by Bob Ciura)

Warren Buffett (Trades, Portfolio)'s investment conglomerate, Berkshire Hathaway (BRK-A) (BRK-B), has a $148 billion stock portfolio. Buffett has filled his portfolio with high-quality dividend growth stocks.

Warning! GuruFocus has detected 4 Warning Signs with SSYS. Click here to check it out.

The intrinsic value of GM

One such dividend stock is General Motors (GM). GM makes up approximately 1.2% of Berkshire's portfolio.

GM does not have a long history of paying dividends--the post-bankruptcy GM has only four years of dividend payments under its belt.

As a result, it will need several more years before it becomes a Dividend Achiever, a group of 272 stocks with 10-plus years of consecutive dividend increases.

You can see the full Dividend Achievers List here.

But now that GM has resumed paying steady dividends, it is an interesting consideration. It has a hefty 4% yield.

In addition, thanks to continued market pessimism, the stock is very cheap.

Buffett famously looks for companies with share prices that are trading at a discount to their perceived intrinsic values.

Based on GM's low valuation and high dividend payout, it is not hard to see why Buffett owns the stock.

Business overview

Investors probably still have bad memories of GM given the company's high-profile bankruptcy in 2009 and ensuing rescue by the U.S. government.

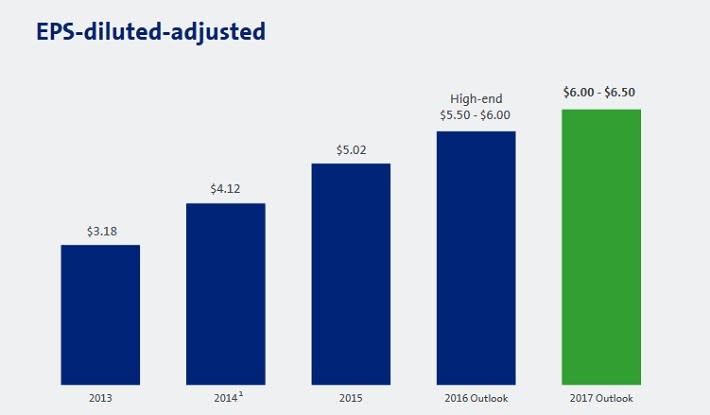

The good news is, now that the company has righted the ship, it is on much firmer footing. Earnings per share, as adjusted for non-recurring costs, nearly doubled from 2013 to 2016.

Source: January 2017 Global Auto Industry Conference, page 2

Last year, GM's revenue and adjusted EPS increased 9.2% and 21.9% respectively. These strong results were fueled by rising vehicle sales and improved margins.

GM sold 10 million vehicles in 2016, up 1.2% from 2015.

The two main drivers of this growth were Chevrolet and Cadillac. Chevrolet gained 0.5% of domestic market share, while sales of Cadillac vehicles rose 11% for the year.

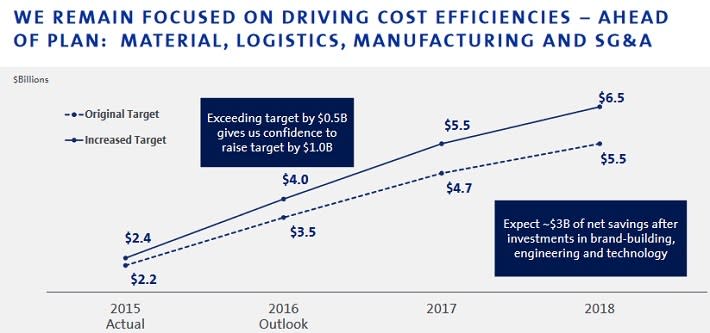

Moreover, adjusted earnings before interest and taxes (EBIT) margin rose 40 basis points in 2016. The company has removed billions from its cost structure across several functions, including materials, logistics, manufacturing and SG&A.

Source: January 2017 Global Auto Industry Conference, page 31

2016 was a banner year: GM set company records for revenue, adjusted EPS and adjusted return on capital.

Last year capped off what has been one of the strongest periods for U.S. automakers in recent memory. Auto sales have reached record levels in the U.S. due to the economic recovery, falling unemployment, low gas prices and low interest rates.

Investors are doubting whether GM's momentum will continue for much longer. But importantly, GM expects 2017 to be another year of growth.

Growth prospects

Overall, GM expects 2017 adjusted EPS of $6 to $6.50. At the midpoint, adjusted EPS are expected to increase 2.1% from 2016.

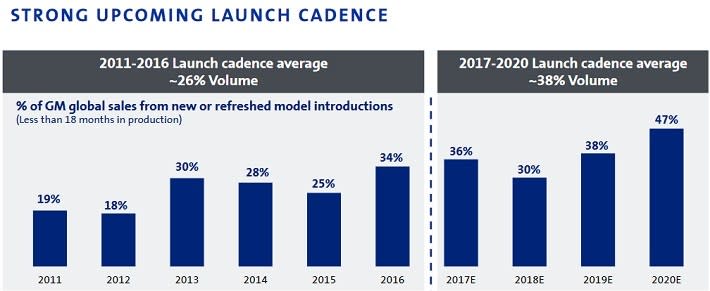

One of the catalysts on GM's radar is new launches. The company has a wider slate of new vehicles set for release in 2017 to 2020 than the past few years.

Source: January 2017 Global Auto Industry Conference, page 16

Another compelling growth catalyst for GM is innovation. GM has invested billions in innovation and has four growth initiatives moving forward. These are connectivity, alternative propulsion, autonomous vehicles and ride sharing.

Source: January 2017 Global Auto Industry Conference, page 6

GM has over 12 million connected vehicles. It also has a strong position in electric vehicles with the Chevy Bolt. GM delivered the first Bolt EVs to customers in the fourth quarter.

The Bolt EV could be a market disruptor. Demand for electric vehicles in rising, costs of production are falling and the Bolt EV won the 2017 Motor Trend Car of the Year award.

Next, driverless cars are an emerging area of interest for automakers. GM acquired autonomous vehicle startup Cruise Automation for $1 billion last year.

GM also invested $500 million in ride-sharing service Lyft.

These investments put GM in a prime position to capitalize on the changes taking place in the auto industry.

Valuation & balance sheet

One of the most attractive aspects of GM stock is that it is dirt cheap. Shares trade for a price-earnings (P/E) ratio of just 6, well below the S&P 500 Index average P/E ratio of 26.

The reason why the stock is so cheap is persistently negative sentiment. Investors are worried that the record auto sales of the past few years are about to come to a screeching halt.

While it is true that interest rates are creeping higher, as are oil prices, GM's huge financial arm remains in good standing.

GM Financial generated $9.6 billion of revenue last year, up 48% year over year. Net charge-offs ticked up 10 basis points but are still just 2% of finance receivables.

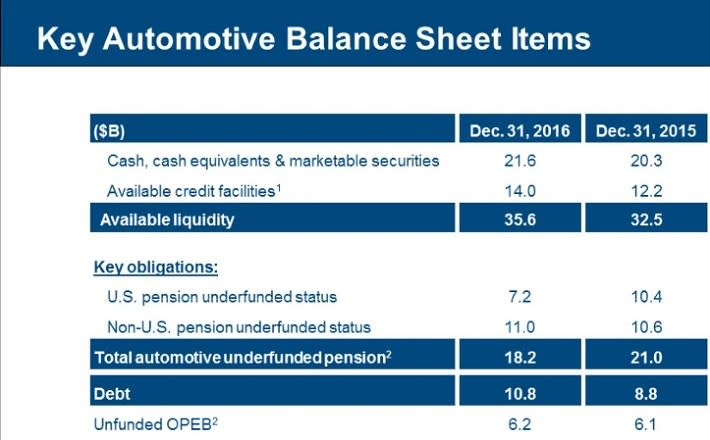

Plus, GM has prepared for a potential deterioration in its credit portfolio by hoarding cash on the balance sheet.

At year-end, GM held $21.6 billion of cash and another $14 billion in available credit. This exceeds its combined company debt and underfunded pension liabilities.

Source: 4Q Earnings Presentation, page 25

GM's dividend will be a significant source of expected returns moving forward. This is not surprising; since GM generates so much free cash flow, it can easily return billions to investors each year in share repurchases and dividends.

Source: January 2017 Global Auto Industry Conference, page 33

GM stock yields 4% and should be able to continue growing its dividend in the years ahead.

The stock has a forward dividend payout of $1.52 per share. In 2017, the company expects adjusted EPS will reach $6.25, at the midpoint of guidance.

This means GM is likely to maintain a 24% payout ratio. GM will essentially distribute less than one-quarter of its earnings this year. That is a very modest payout ratio that leaves plenty of room for future dividend increases.

Final thoughts

With such a low valuation multiple, it is apparent GM is not getting much credit for all the progress it has made since the Great Recession. Investors are still wary of auto stocks.

While a certain level of pessimism is understandable, given the last recession nearly put GM out of business, the fear seems excessive.

It is worth noting GM is a different company today than it was in 2008. It has a stronger balance sheet and its sales are rising at a steady pace.

With a 4% dividend yield and a P/E ratio of just 6, GM appears to be significantly undervalued.

It is easy to see why the "Oracle of Omaha" has a major position.

Disclosure: I am not long any of the stocks mentioned in this article.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with SSYS. Click here to check it out.

The intrinsic value of GM