Bruce Berkowitz Increases 3 Positions in 2nd Quarter

- By James Li

Established Dec. 29, 1999, the Fairholme Fund (Trades, Portfolio) seeks long-term capital growth through various equity securities, including common company stock and real-estate investment trust interests.

Warning! GuruFocus has detected 5 Warning Signs with JOE. Click here to check it out.

The intrinsic value of JOE

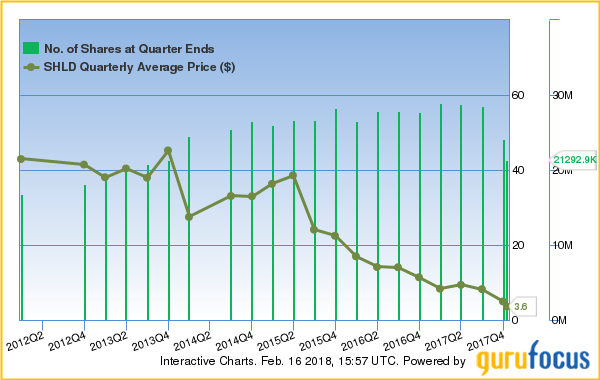

Chief Investment Officer Bruce Berkowitz (Trades, Portfolio) added to three positions during the second quarter: Sears Holdings Inc. (SHLD), Bank of America Corp. (BAC) and The St. Joe Co. (JOE).

As mentioned in a previous article, Berkowitz has generally increased his stake in Sears throughout the past five years. Continuing this trend, the director of Sears added 4.75% to his stock position in the past quarter.

Even though the company's financial outlook deteriorated during the past few years, Berkowitz still sees high potential for growth. In his semiannual letter, the Sears director stressed his optimistic views about the company: the management of Sears can restore the company's profitability by operating as a "member-centric integrated retailer." In other words, by exploring strategic alternatives for its home services and logistics, the specialty retail company can create value for shareholders and increase its growth potential.

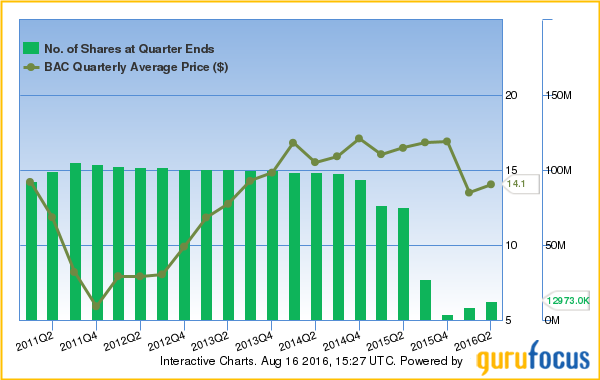

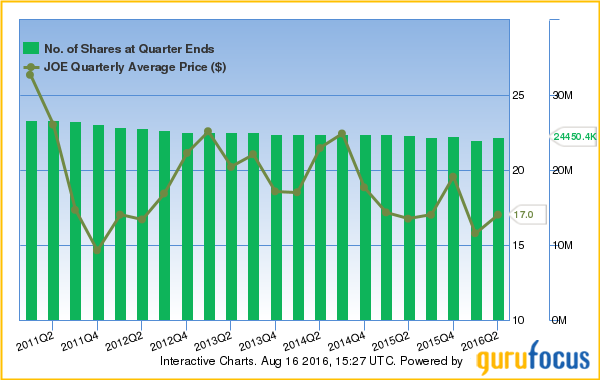

Berkowitz also added 51.35% to his stake in Bank of America and 1.95% to his position in St. Joe.

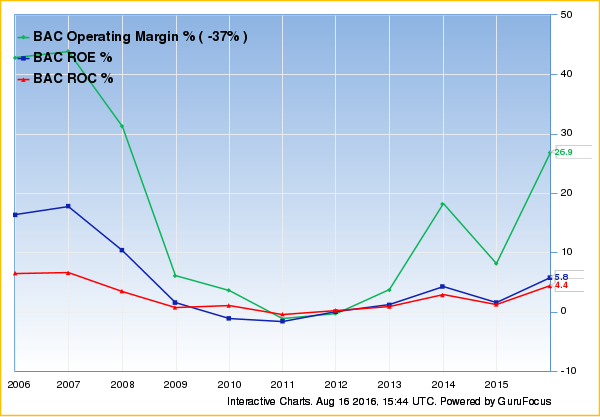

With a financial strength rank and profitability rating of 5, Bank of America has a modest business operation. The company's operating margin and return on equity currently underperform 65% and 74% of all global banks. Additionally, the company's return on invested capital is slightly lower than the WACC, implying mild reduction of value.

Despite the low margins, Bank of America still has high potential for growth. The company is slightly undervalued based on its Peter Lynch chart. As mentioned in Berkowitz's shareholder letter, the bank's stock price is less than its tangible book value per share. Additionally, regulatory approval for a 50% dividend increase and $5 billion in stock repurchases can potentially improve the bank's capital allocation.

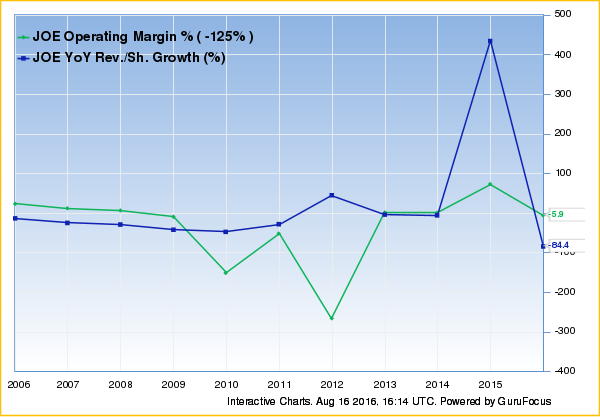

Like Sears, St. Joe has a modest financial outlook. The real estate services company currently has a negative operating margin and three-year revenue growth, implying loss potential in the short term. Additionally, the company's Sloan ratio suggests that the majority of its earnings come from accruals.

According to his shareholder letter, Berkowitz increased his position in St. Joe likely to hedge against rising inflation despite the poor earnings. The Sears director expects the real estate company to have a positive trajectory on the owned land.

See also

You can view the latest guru picks under the "Gurus" tab. Additionally, you can track the top 10 holdings of each of the gurus, including Berkowitz. As of June 30, the Sears director's top three holdings are St. Joe, Sears and Bank of America.

Disclosure: The author does not have any position in the stocks mentioned in this article.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with JOE. Click here to check it out.

The intrinsic value of JOE